MONETIZING BIG DATA IN THE NEXT-GENERATION MOBILITY

In my book and previous posts, I build a broad case for the importance of big data and AI in next-generation mobility, and provide several examples of data that is being collected, or can be collected, in a variety of transportation and logistics situations. Next-generation mobility is about autonomous vehicles, electrified vehicles, and on-demand shared mobility and the use cases they enable. It is also about how to best utilize available transportation and logistic resources, in conjunction with various types of autonomous vehicles, to address some of our biggest challenges. These include pollution and climate change, urbanization and congestion, aging population, traffic fatalities, and injuries, as well as maintaining economic prosperity by operating highly optimized supply chains that span the globe. As I continue to analyze the value chains that emerge in next-generation mobility, it is important to look closely at the functions big data and AI enable in the major use cases for such vehicles, and the monetization that can result through these functions beyond a vehicle’s autonomous movement.

Despite the growing number of announcements about technological achievements, investments, partnerships and acquisitions relating to autonomous vehicles, we are still several (7-10) years away from the broad utilization of vehicles with Level 4 or Level 5 driving automation. I focus exclusively on these two levels of driving automation because only once we achieve these levels will we be able to fully benefit from autonomous mobility. However, between now and then we will continue to see autonomous vehicles evolve and be used in increasingly complex situations.

While most news is about consumer transportation in personal autonomous vehicles, as we continue to experiment with and dream about applications for autonomous vehicles (electrified or equipped with internal combustion engines), we envision six basic use cases of increasing complexity. The sequence in which these use cases will be deployed and their success will depend on our ability to create the right technologies, devise the right business models, and institute the appropriate regulations. With particular regards to technology, one of the biggest obstacles for the broad utilization of autonomous vehicles concerns their ability to deal with dynamic environments that change unpredictably. For example, while driving down a San Francisco street an autonomous vehicle may need to deal with pedestrians jaywalking (and in the process distinguish whether the jaywalker is a lone adult, a handicapped individual, an adult accompanying a child, etc.), bicycle messengers cutting through traffic lanes, a bus that suddenly has to move outside its prescribed traffic lane in order to get around an illegally parked delivery truck, and other such situations. While our autonomous vehicle technology is getting better at dealing with such unpredictable changes to a traffic environment, there is still a lot of development and testing work that needs to be done.

SIX USE CASES FOR AUTONOMOUS VEHICLES

The six use cases for autonomous vehicles ranked by increasing traffic environment complexity are:

- Specialized vehicles operating in controlled environments. Corporations have already started deploying specialized vehicles for applications that involve highly controlled and, often, dangerous environments such as hauling ore in open-pit mines, planting, maintaining crops, and harvesting in farms, and transporting containers within ports. Trials, and even deployments, for additional specialized applications will continue in increasingly dynamic environments such as urban garbage collection.

- Trucks used in long-haul freight logistics. There are several factors that motivate the use of autonomous trucks for freight transportation between distribution centers that are outside city limits: digital, global and highly optimized supply chains, shortage of long-haul truck drivers, fuel savings, driver safety, economics and others. Utilizing freeways, and maybe even specially designated lanes in freeways, provides for environments that are more stable and consistent and less complex, compared to urban settings. The first significant tests for this case will start in 2018 and involve truck platooning.

- Vehicles used for short-haul package delivery. With the continued explosive growth of ecommerce, the need for short-haul package delivery, particularly last-mile delivery, and returns has increased dramatically. The industry is exploring numerous different options to provide short-haul delivery including special-purpose vehicles. Tests of such vehicles have started and more are planned for the near future. Though the technology employed by the special-purpose autonomous vehicles is impressive, the business cases and associated models, as well as the necessary regulation have not yet been fully defined. One has to remember the Segway, which also employed an impressive array of technologies to address personal urban mobility but encountered several obstacles, including business model and regulation-related issues, in establishing a viable business case.

- Passenger shuttles. Autonomous, electrified passenger shuttles will come in different forms. Today they are providing transportation in a variety of university campuses, and other controlled environments that have low traffic, and impose low speed restrictions. Additional trials are on the way. Over time such shuttles will be introduced in increasingly complex urban settings to provide, first-mile/last-mile transportation to private and public mass transit systems, as well as transportation for the elderly and people with disabilities.

- Cars used for ride-hailing. I have already discussed in other publications the advantages that autonomous vehicles will provide to companies offering urban and medium-haul (up to 150 miles) ride-hailing services. They include the ability to reduce operating costs, achieve higher profit margins, and tocontrol the overall user experience. While trials of growing scope will continue, the broad use of autonomous vehicles for such applications is several years away and will depend on achieving the right technology reliability, identifying the right business model, instituting the appropriate regulations, addressing potential liability issues and achieving consumer comfort with the service.

- Vehicles used for private transportation. The growing proliferation of mobility services particularly those that blend on-demand with scheduled mobility (in the form of public and private mass transit) will negatively impact private car ownership but will not eliminate it. Automotive OEMs will definitely offer vehicles with Level 4 and Level 5 driving automation initially at their high-end models, and, as the price of the components that comprise the autonomy platform drops, to lower-price models that target broader segments of the market.

Three observations relating to the use cases presented above:

- Five of the six use cases involve fleets rather than private vehicles. A case can be made on whether autonomous farming equipment will be privately owned or owned by fleet operating companies.

- Two of the use cases are about freight transportation and three about consumer transportation. In the first use case one can also identify freight transportation subcases, e.g., container transportation in ports.

- The value chains associated with use cases 2-5 have much in common and require detailed analysis.

THE NEW VALUE CHAIN

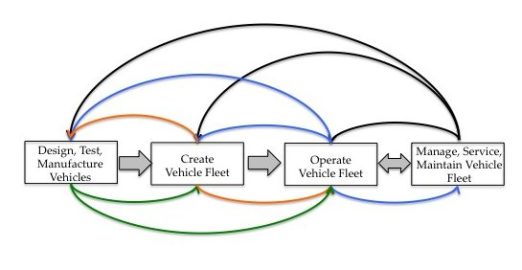

The value chain associated with fleet-based people or freight transportation consists of four basic components as shown in Figure 1:

- Designing, testing, and manufacturing the vehicle. In addition to all the steps associated with the design, test, and manufacturing of conventional vehicles, autonomous vehicles include the platform (hardware and software) that enables their Level 4 or Level 5 autonomy. This is what I’ve been calling the ACE Platform, since I have assumed that most of the autonomous vehicles that will go into production, particularly those used in passenger mobility and small package delivery, will be electrified.

- Creating a fleet. This involves ordering a fleet of vehicles that have specific configurations, financing the fleet’s purchase, insuring it, and leasing the configured vehicles to the fleet operator. The configuration of vehicles may be specific to a) the application, e.g., single passenger transportation and small package delivery or shuttle transportation, b) the environment where they will be operating, e.g., taking into a account the characteristics of a specific city such as New York, and c) the regulations of the operating environment, e.g., those of a city, state, or country. Vehicles for passenger transportation may also be configured to incorporate what I’ve been calling the User Experience Platform (UX Platform). While in several cases the fleet operator could be the same entity that creates the fleet, we can also imagine the emergence of corporations that create various types of autonomous vehicle fleets and then lease vehicles to fleet operators.

- Operating the fleet. This involves taking reservations, managing the logistics and safety of passengers or freight, managing the network of vehicles while they operate to ensure the smooth execution of the reservations, monitoring each vehicle’s health, and being responsible for the overall user experience (obviously this is particularly important in the case of passenger transportation, but also important to the shipper who uses such services). Mobility Services companies such as Uber and Lyft may evolve their current business models towards this role, and we could vehicle manufacturers such as GM establish a similar business with mobility units such as Maven. In the case of passenger vehicles, user experience should extend outside the vehicle and, as I mention in the book, should include the consumer’s entire ground transportation experience. If the vehicles used for passenger transportation are already equipped with a UX Platform, the fleet operator adds value by configuring this platform. Alternatively, the operator may have its own UX Platform with which it equips the vehicles in its fleet. A simple example of such vehicle configuration is the Neverlost GPS and travel information platform with which Hertz equips certain of its passenger vehicles.

- Managing the fleet. This involves parking the vehicles when they are not in use, refueling or recharging the vehicles, cleaning and generally maintaining and servicing the vehicles to ensure their maximum availability and the best user experience, dealing with accidents as they occur, and repairing the vehicles as necessary. Car rental companies are viewed as natural candidates for fulfilling this role. However, even though they have fleet operations and management knowledge and experience, they will need to replace their legacy software systems with new data-driven software platforms to perform these tasks for autonomous vehicle fleets.

THE VALUE ADDED BY BIG DATA AND AI

The value of big data and AI for perception, localization, and planning, as well as map creation and other aspects of autonomous movement have already been documented and apply in all of the six use cases presented above. Obviously the performance of autonomous vehicles improves as more data is collected from test and production vehicles because such data leads to the continuous improvement of the perception, localization, and planning modules. It is improvements along these areas that will enable us to move to the more complex use cases. The same can be said about mapping, particularly as we will need to constantly update the high definition maps that are required by autonomous vehicles, or in order to create a new high definition map. However, the value of big data and AI is equally important in other parts of both the passenger and freight transportation value chains. In particular, big data and AI enable:

- The vehicle’s design, test, and manufacturing. Data from fleet creators, fleet operators, and fleet managers and maintainers should be utilized during vehicle design and testing to improve subsequent generations of technology, systems and vehicles. Manufacturing data from current and past efforts should also be utilized extensively. In some cases it may also be feasible for different manufacturers to share production data in an effort to improve their economics, especially on shared systems such as jointly developed platforms. Cloud-based systems such as the one built by our portfolio company Divergent3D will make such sharing possible. Simulation systems such as those built by our portfolio company Metamoto will also utilize data from fleet operators and combine it with synthetic data to test the performance of various ACE Platforms.

- The fleet’s creation. The configuration specification provided by fleet creators to fleet manufacturers, as well as the per vehicle price and other related terms such companies will negotiate with vehicle manufacturers, fleet financing institutions and insurance companies can all be informed by the use of data. Data from past fleet orders, as well as each fleet’s performance data, on a vehicle by vehicle or aggregate basis, provided by the fleet operator and the fleet manager are also very useful in this area.

- The configurability and personalization of the vehicle’s cabin for each passenger, group of passengers, and/or driver (in the case of vehicles with L4 driving automation), as well as the configuration of a freight vehicle depending on the type of items being transported each time. Fleet operators (shuttles, ride sharing vehicles, single-occupancy ride hailing vehicles, package delivery vehicles, etc.) collect passenger or package data, as well as vehicle operating data, from each job. Obviously, the more consumers use such mobility services the more precise and granular the personalization will be, as we currently see in the case of ecommerce.

- The creation of end-to-end personalized ground transportation and logistics solutions. This is a new and potentially differentiated opportunity for companies working on next-generation mobility. It involves working with personal mobility, routing, scheduling, traffic and many other forms of data. AI is used in order to combine the data and to make inferences about how to provide such end-to-end solutions on an individual basis. The use of such solutions leads to increased loyalty towards the fleet operators, and the vehicle OEM (in the case of personal vehicles) which itself results in lower customer retention costs, and could also lead to lower customer acquisition costs, if want to utilize transportation providers that offer such capability. Our portfolio company Safegraph is creating and analyzing data from a variety of sources in order to provide such solutions.

- The management and optimization of fleet operations. It will be extremely important to create such a platform to track the performance of each vehicle in a fleet, along with data about the type of jobs each vehicle is fulfilling. As I mentioned above, car rental companies that want to participate in next-generation mobility will be among the first to need such platforms. My intuition tells me that the more data we collect relating to the management and maintenance of vehicles, the better optimization we will be able to make. Airlines provide a very good example of what is possible by continuously collecting such data.

- The better utilization and optimization of transportation infrastructure, particularly of urban infrastructure. Cities have started instrumenting their transportation infrastructure using a variety of sensors and IoT. The data collected from this instrumentation will enable the better utilization and optimization of the transportation infrastructure ultimately leading to lower maintenance costs for the transportation infrastructure, new revenue streams for the cities, and the development of urban plans that better utilize the available space while providing for better and safer transportation.

Figure 2 depicts the necessary data flows across the value chain shown in Figure 1.

MONETIZING THROUGH BIG DATA AND AI

As an investor to startups working on next-generation mobility solutions, and advisor to large corporations in this sector, I’ve been particularly interested on how to monetize the value provided by big data and AI. Monetization will result from new revenue streams but also from lower costs across the entire value chain. New revenue business models will include: subscriptions, micro transactions, advertising, and loyalty point redemption. Thus far I have identified the following opportunities:

- Vehicle manufacturing. The use of data and AI will lower the automakers’ warranty costs and could also lower their marketing budgets to fleet creators, fleet operators, as well as to consumers who will buy such vehicles for their private use. Moreover, automakers can achieve higher margins by utilizing 3D printing-based, small-batch manufacturing systems in conjunction with big data and AI to satisfy complex requirements in vehicles produced in small volumes.

- Fleet creation. Because of the use of data fleet creators will be able to negotiate lower per vehicle price thus positively impacting the overall investments made by fleet creation companies, and influence the terms they will negotiate with fleet operators by determining the terms under which they will lease a fleet to the operator.

- ACE Platform. Automakers and fleet operators seek to develop a reliable, and highly configurable stack that enables Level 4 and Level 5 autonomous mobility under any condition and with the highest safety. Such ACE Platforms will result in businesses that have better margins than any other vehicle component. This is why there are so many companies from incumbent automakers to Tier 1 suppliers and startups working on the development of such platforms. As we are already seeing with Tesla, an extensible ACE Platform offers monetization opportunities through subscriptions to receive OTA updates, and the acquisition of new features from the automaker, the ACE Platform provider, the fleet operator or a network of partners through transaction-based, advertising-based, or loyalty program-based business models. Fleet operators or drivers (in case of vehicles with L4 driving automation) can initiate subscriptions and/or one-off transactions.

- UX Platform. Automakers and fleet operators also seek to develop a highly configurable and connected stack that may be split between a consumer’s mobile device and the vehicle’s infotainment system that personalizes the consumer’s transportation experience in and out of the vehicle. The personalization will lead to increased loyalty, lowering customer acquisition and retention costs. Next-generation mobility dramatically changes the notion of loyalty. It transforms it from brand loyalty that may be measured once every few years when the consumer has to buy or lease a vehicle, to daily loyalty that must be measured on a transaction-by-transaction basis. As such, the UX Platform offers monetization opportunities through Passenger Commerce (or Driver Commerce in the case of vehicles with Level 4 driving automation). Commerce could be conducted via:

- Subscriptions to access content, e.g., an annual subscription to Apple Music, or a service, e.g., concierge.

- Transaction-based purchase of goods, services, and content while being transported, as well as when vehicles stop at refueling stations during long trips. For example, a recharging station operator, such as an energy company, can partner with a coffee shop chain for offer discounts in coffee drinks purchased while refueling a vehicle.

- Redemption of loyalty points. Automakers and fleet operators can reward their customers for their loyalty using a system similar to that used by airlines or hotel chains. These points can then be redeemed in much the same way these and other industries use such programs. For example, for every 5,000 ridesharing miles in a particular automaker’s vehicles, the consumer receives points that are redeemed towards free cellular data to be used in their personal vehicle.

- Fleet management platform. By tracking the right data through this platform it is possible to drive the maximum utilization of each vehicle per location (which will undoubtedly be different in New York than in San Francisco, or in Singapore), while controlling the fleet operator’s costs, and improving vehicle economics, fleet management and maintenance economics, lower the fleet insurance economics, and increase the vehicle’s utilization and the corresponding fleet’s performance thus improving the overall economics of the fleet operators.

- Subscriptions and advertising revenue can be used to monetize data services that enable the ACE Platform, UX Platform, the fleet management platform, and the fleet operations platform with proprietary data, e.g., mapping data from HERE, traffic and parking data from Inrix, quality of service data from JD Power, etc.

- Global ground transportation reservation systems. These systems that can connect on-demand mobility services companies, companies providing scheduled mobility, e.g., public transportation systems, and owned mobility, can be monetized through revenue sharing from the transactions. In addition, they generate consumer loyalty to specific brands with the indirect financial benefits previously discussed.

By understanding the emerging value chain for the envisioned autonomous vehicle use cases, and appreciating the role of big data and AI, we can create opportunities that will lead to high-value business models at a time when the traditional automotive business models continue to face margin compression and declining value, while today’s formulation of the models used in ride-hailing and ride-sharing are not going to fare much better, despite the high valuations commanded today by the companies that offer such mobility services.

Leave a Reply