OEM Transformations: The Benefits of Subscription Models

Recently we entered the second phase of next-generation mobility, the Fleet-Emergence Phase that is projected to last about a decade. The covid-19 pandemic is causing metropolitan areas to rethink consumer mobility and goods delivery, and urban consumers to reconsider vehicle ownership concerned about the contagion risk posed by public transportation and on-demand mobility services. Automotive OEMs should use this opportunity to analyze their models and decide when and how to transform. As I describe in my forthcoming book Transportation Transformation, while personally driven vehicles will continue to be used during this phase, the changes we have seen over the past 10 years in urban consumer transportation preferences with the ascend of on-demand mobility services should have convinced OEM executive teams that significant transformations of their business are necessary. For some OEMs transformations will imply producing vehicles that are based on sophisticated technologies, such as self-driving cars. For others it will imply the adoption of new business models. OEMs will start offering vehicle subscriptions and mobility services directly to consumers as a result of their transformation. In order to do this effectively they will need to create and operate fleets.

Over the past 70 years, the automotive industry has been operating largely under the same model. They produce vehicles that they sell or lease to consumers through their dealer networks, and directly to fleet management companies. The pandemic, combined with low gas prices, and favorable financing terms (now stretching to 7-year loans) are leading more people to reconsider private vehicle ownership. But the high levels of unemployment that resulted from the pandemic, the uncertainty about how quickly economies will recover and the prospect that such a recovery may not result in the pre-pandemic employment levels , as well as the hassles associated with car ownership (insurance, depreciation of an asset that remains unused over 90% of the time), mean that it will take several years before car sales return to their previous levels. Facing this prospect on top of a variety of other long-standing issues must lead automotive OEMs to transform and adopt different models. Subscription models should be at the a top consideration. Such models enable continuous value exchange between OEM and subscriber.

Subscribers gain access to vehicles that address their different needs as opposed to a single vehicle that has to act like a “Swiss Army knife” as is the case with purchase and leasing models today. For example, during the work week the consumer may only need a small vehicle for commuting to and from work, but during weekends they may need a small SUV to run major errands or go to family outings. Subscriptions provide consumers with the convenience of having a vehicle parked outside their residence for at-will access without the constraints imposed by a lease or ownership. A subscription period will typically be shorter than the lease. The subscription includes the access to the vehicle but also every other expense associated with operating the vehicle, such as maintenance, insurance, parking access, etc. It enables the consumer to:

- Get access to a vehicle for lower overall monthly payment compared to the lease or ownership options;

- Assess the value they are getting from this arrangement;

- Always access the latest features with which the vehicles in the selected subscription tier are equipped;

- Evaluate whether to renew the subscription at the current level or even upgrade to a higher level.

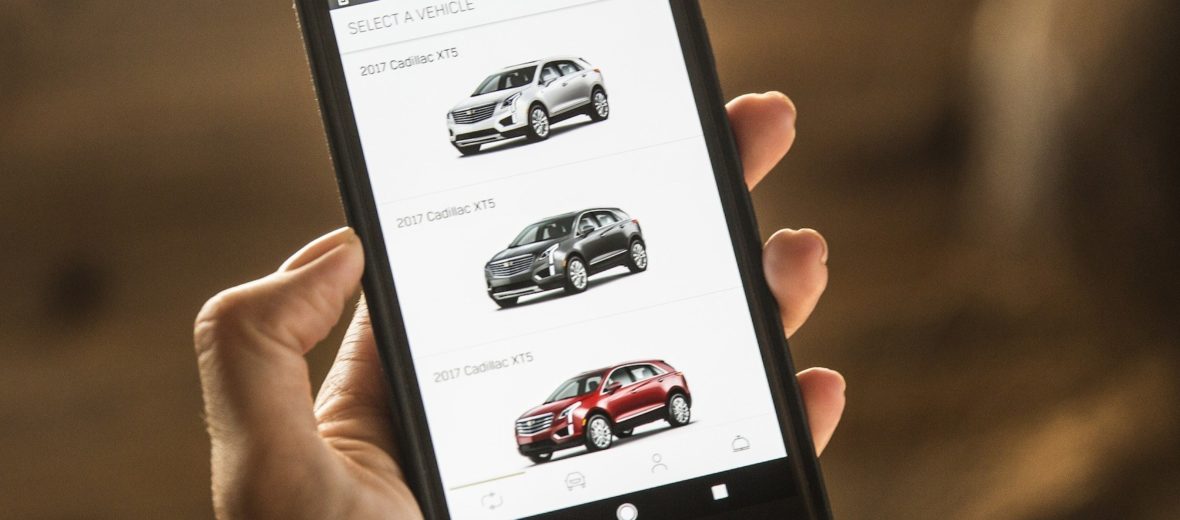

To the OEMs, vehicle subscriptions provide an annuity revenue stream, the opportunity for frequent direct and indirect interactions between consumer and OEM that will unquestionably strengthen the relationship between the two parties. The higher frequency and greater variety of interactions will enable the OEM to better understand the consumer’s immediate transportation needs and try to better serve them, in the process increasing the share of the “consumer transportation wallet.” Today car dealers and mobility services companies have a closer consumer relationship which they constantly use to their benefit. Frequent and direct interactions will also help OEMs determine how future vehicle designs and transportation-related services will address the consumer mobility needs. In fact, over time I can foresee subscriptions that offer a combination of vehicle access and on-demand mobility services. High-end OEM brands such as Mercedes, Volvo, Cadillac, and Lexus have experimented with vehicle subscriptions that included some driver-centric services such as parking and concierge access.

The adoption of subscription models will also provide OEMs with a great opportunity to establish direct-to-consumer sales. To date Tesla and a few companies selling used vehicles, like Carvana, adopted Internet-based direct-to-consumer sale or lease business models. Incumbent OEMS have tested online sales, but those efforts remained small-scale business experiments. During the pandemic OEMs started to promote online, contactless sales. Ford reports that online sales jumped to 20% compared to low single-digits before the pandemic. In addition to becoming proficient with direct-to-consumer models, the adoption of subscription models will

turn OEMs to fleet managers and operators. It will require them to keep vehicles on the books for long periods, something they have resisted to date. It will also necessitate that they acquire new skills for fleet management and fleet operation. GM and Ford, both of which started and subsequently abandoned car sharing services, found it difficult to master that these skills and make their services successful. The lengthy market analyses and strategy reviews OEMs conducted in the past did not lead them to fundamental transformations and left them unable to take advantage of the changing urban consumer transportation preferences. The transformations they now choose to undertake and the models they adopt will determine the value chains they will be able to participate and the types of value they can derive. In the book I present several alternatives. Large corporations typically find it easier to transform across the technology dimension rather than the business model dimension. The automotive industry is no exception. A few days ago, while discussing the company’s first-quarter results, GM’s CEO reiterated that the company will maintain its investment pace in electrified and autonomous vehicles. While such investments are necessary, the transformations these companies must undertake are more imperative.

Leave a Reply