The three phases of next-generation mobility

In my forthcoming book Transportation Transformation I define next-generation mobility as the intelligent movement of people and goods using automated (or autonomous), connected and electrified vehicles. Next-generation mobility is still in its infancy, but I predict it will unfold in three phases. Over the past ten years, a period which I characterize as its first phase, people living in urban areas started to adopt on-demand mobility services, such as ride-hailing, micromobility, and food delivery. Over the next 20-30 years, we expect to go through two more phases before the vision of next-generation mobility for transportation and delivery as-a-service can be fully realized. However, the models currently being used by the companies involved in transportation will not get us there. Transformations will be necessary.

As we enter the 2020s, the second phase of next-generation mobility, the Fleet Emergence Phase, is starting. But the COVID-19 pandemic is altering some of our projections regarding how this phase will unfold. We have been expecting that urban consumer adoption of on-demand transportation will continue accelerating with such services rapidly crossing the chasm and be used by the early majority. We were also anticipating that early on in the Fleet Emergence Phase passenger transportation services using autonomous vehicles would launch commercially. But because of the pandemic, consumers are dramatically decreasing the use of transportation services, a trend that, if not quickly reversed, it will significantly delay the broad introduction of robotaxi and autonomous shuttle services. Consumers will go back to using their privately-owned vehicles (POVs), feeling that they provide them with the necessary social distancing and better protection against possible infection. The question is for how long.

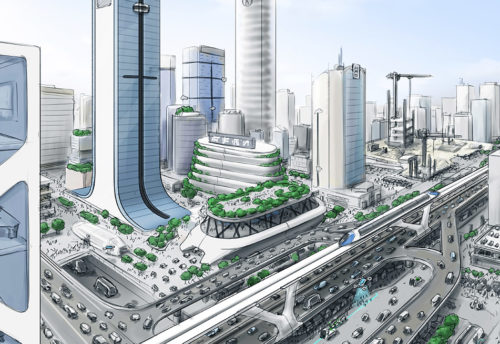

Despite such delays, I expect that the Fleet Emergence Phase will propel us meaningfully towards next-generation mobility. During this phase, on-demand mobility services for passenger transportation and goods delivery will continue to grow well. Cities like Madrid, Oslo, and a few others that had already banned POV use in their centers will not reverse their policies even if temporarily they put them on hold. As we put the COVID-19 pandemic behind us and learn important lessons about how to best respond to similar crises that will likely follow, more cities around the world will restrict the use of POVs in their centers. These and many other cities globally will aggressively deploy intelligent transportation, communication, and electrification infrastructures. They will also start to put in place the regulatory foundations that are necessary for achieving their goals as one of the three major constituencies shaping next-generation mobility. All these steps will require the transformation of cities.

The continued trade friction among nations, and additional emissions regulations that will be introduced globally, will lead to the reshaping of the incumbent automotive ecosystem. Traditional sales through dealer channels will decline worldwide. The COVID-19 pandemic is starting to necessitate this change as consumers learn to operate without leaving their homes. New vehicle sales will suffer as the use of mobility services for passenger transportation and goods delivery will increase and used vehicles will start flooding the market because the changing economic environment causes rental car companies and corporations to decrease the size of their fleets, consumers to default on their automotive loans, and leases to end. As a result, during this phase OEMs will need to transform. The result of this transformation will be additional consolidation among the automotive OEMs resulting in a smaller ecosystem, large-scale partnerships between OEMs, similar to those already announced between Ford and Volkswagen, and the development of new ecosystems and value chains supported by novel business models. Some OEMs will transform to offer multimodal transportation services using fleets of their own vehicles, as GM is doing, but also partnering with mobility services pure-plays globally to offer transportation services, as Toyota is doing with Grab.

During the Fleet Emergence Phase, the larger Transportation Network Companies (TNCs) will start transforming into fleet operators and to coordinate with public transportation options giving cities a strong role in the shaping of mobility. In response to regulation and economic considerations, mobility services companies will start incorporating into their fleets vehicles that are equipped with advanced technologies: electrified vehicles, vehicles with next-generation ADAS, and eventually, autonomous vehicles of different form factors. Autonomous vehicles will initially be utilized in smaller, well-constrained, geofenced areas. During the decade, as the technology of these vehicles improves, the geofenced areas where they can operate safely will expand, and autonomous vehicles will be used for a greater variety of trips. Some of these autonomous vehicles, like passenger pods, will be purpose-built for a specific type of mobility service, while others, like autonomous minivans for microtransit, will be the result of regulation by cities. The cost per mile of mobility services will continue to decrease because of the increasing use of ridesharing, growth in city-corporate coordination, and the introduction of autonomous vehicles.

By the early ’30s, we will enter The Mobility-as-a-Service Phase. By then, OEMs and mobility services companies will have completed their transformation. In addition, several cities around the world will have completed their own transformations. In many urban areas, the only transportation option will be multimodal and shared MaaS using a variety of autonomous vehicle form factors to offer affordable, safe, convenient, and personalized transportation of people and goods. This is the driverless future.

The complexity involved and investments necessary to deliver multimodal MaaS at scale mean that only a very small number of providers will be viable in each area. The different regulatory environments, urban infrastructures, and transportation preferences will lead to the emergence of geography-specific MaaS solution leaders rather than global ones. Each MaaS solution provider will deploy large vehicle fleets. The percentage of autonomous vehicles in these fleets will increase, as will the territories where they will be able to operate safely. In several cities around the world, autonomous vehicles of various types will be able to service the entire territory, and for their citizens, driving will become a specialized activity.

Like every other trend that is expected to develop over a long period, next-generation mobility may take longer to unfold than the 30 years I’m projecting. Like with many other megatrends, consumers are expected to have a big role in the pace and the shape next-generation mobility will ultimately take. Where we live has implications on how we move. Regardless of how long it takes, next-generation mobility will require fundamental transformations across the incumbent automotive industry, the nascent mobility services industry but also cities that will no longer be mere spectators.

Leave a Reply