The Urban Transportation Wallet

Megatrends always influence our decisions on where and how to live. Think of the multi-hour commute times in Sao Paulo, or Mumbai, and the pollution in Beijing. Congestion, pollution, noise, climate change, the future of work, and aging societies have a direct impact on transportation globally. Today we are hampered in effectively addressing the impact of transportation on these megatrends because we approach urban transportation as a collection of silos: personally owned vehicles represent one silo, public transportation represent a second silo, and on-demand mobility services a third. This approach impacts how we allocate resources, how we utilize the available transportation infrastructures, and the quality of the overall mobility experience. In Transportation Transformation I observe that for this reason alone urban transportation must transform. The transformation must approach urban transportation as an integrated system of passenger mobility and goods delivery. New urban mobility will emerge as a result of this transformation. New urban mobility will be a shift to the movement of consumers and goods provided as a service using vehicles of various form factors. In this piece I discuss what cities need to do in order to reap the advantages of new mobility and introduce the consumer’s urban transportation wallet as a composite metric for assessing a metropolitan area’s progress towards Mobility as a Service (MaaS).

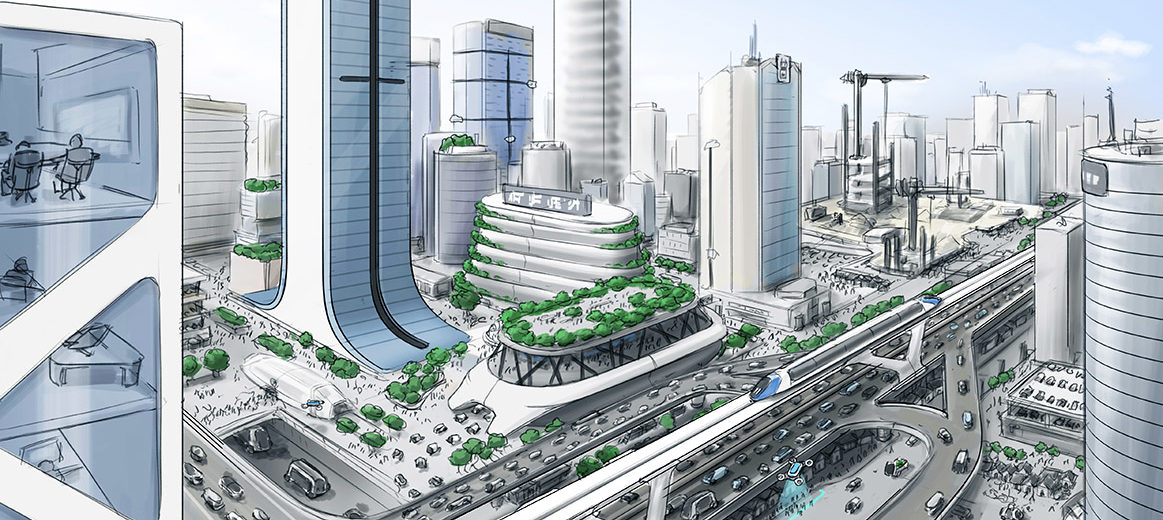

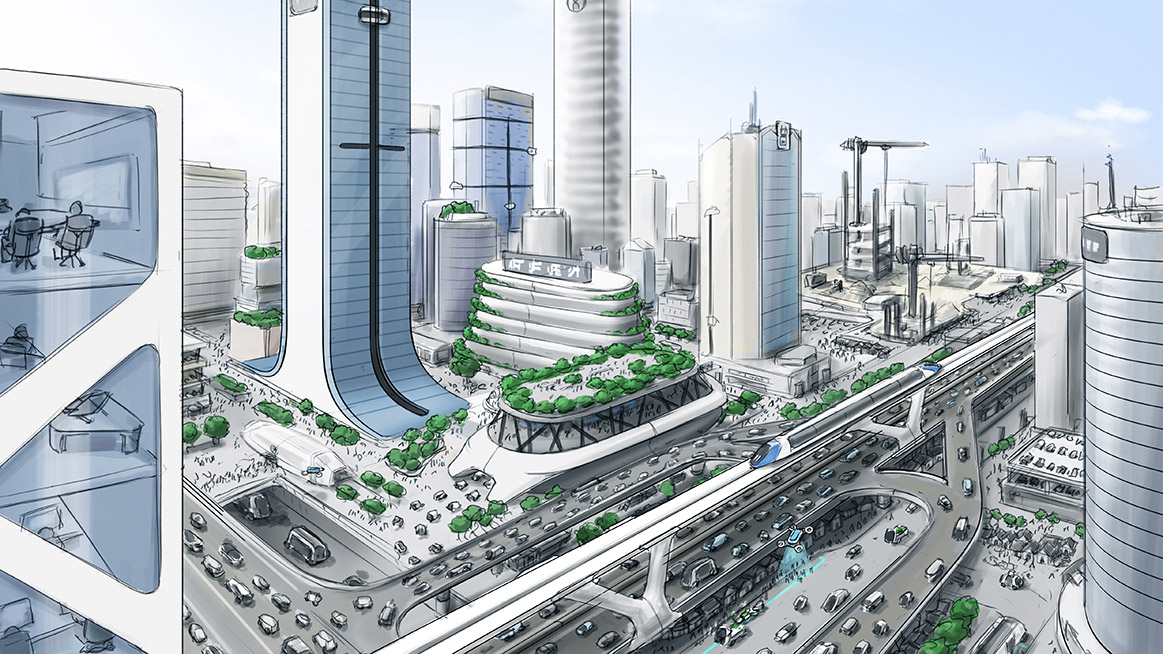

Urban mobility, in general, must be safe, affordable, convenient and offer a good user experience. With varying degrees of success, the public transportation systems of cities around the world strive to excel along these dimensions. New urban mobility requires bringing together the intelligent transportation infrastructures that cities must create, together with multimodal on-demand mobility services, and next-generation public and private vehicles that are automated, connected and electrified.

In order to reap its benefits cities must take a leadership role in ushering new mobility. This will not come easy for every city. Some, like New York and Seattle in the US, Paris, Berlin, and London in Europe, and Singapore, Beijing, and Tokyo in Asia may embrace it. Others may need to first see the results of early adopters before deciding to follow. There may also be many that choose to maintain their mobility status quo. Making new urban mobility a reality will also require that OEMS, mobility services companies and cities collaborate. But before they can collaborate, each of these 3 constituencies must transform.

While details of each constituency’s potential transformations along a consistent framework are provided in the book, it is important to mention the four reasons why cities must transform. First, through their transformation they must define the role they would want to play in new urban mobility, including how they will utilize their public transportation systems. Some cities in the US have already started partnering with mobility services companies to provide more convenient transportation while, in the process, attempting to reduce the growing losses of their public transportation systems. Second, they must learn to manage effectively and in an integrated manner their transportation infrastructure resources: curb, sidewalks, parking spaces, and roads. As new urban mobility advances these resources, particularly the curb and the sidewalk are becoming extremely important for passenger pick up and drop off, as well as goods pickup and delivery. By properly managing and monetizing these resources, cities will be able to fund their participation in new mobility. Third, they must address jurisdictional boundaries which today often negatively impact convenience and user experience and will have even larger negative impact in the case of MaaS. Finally, as part of their transformation cities must determine how to regulate MaaS while enabling it to thrive. Depending on the transformations they decide to undertake, cities will emerge as intelligent transportation infrastructure providers, transportation coordinators that they can improve traffic flow across their intelligent infrastructures, or transportation orchestrators that control the efficient operation of resources used in MaaS very much like air traffic control systems do in the case of air transportation.

The Urban Transportation Wallet captures:

- The number of trips a consumer makes during a specific time period, e.g., a month, by transportation modality, as well as the number of trips that were not made because of using transportation-enabled services, e.g., trips not made to the supermarket because groceries were delivered using a mobility service. It takes into account transportation using privately-owned vehicles, public transportation, on-demand mobility services, including ride-hailing and micromobility, and transportation-enabled services, such as goods delivery, but also transporting the people who provide a service to the consumer, such as bringing a cleaning service to the consumer’s home.

- The amount spent on each transportation modality during the period of interest. This reflects the percent of the consumer’s transportation budget that was spent on each modality utilized but also reflects the modality’s mileage share in the consumer’s mobility plans.

The Urban Transportation Wallet is an extremely important metric because it enables:

- Understanding how heavily each modality is being used, and how frequently it is used by each individual;

- Comparing the use of personally driven vehicles(owned, leased, subscribed) to the use of public transportation and mobility services;

- Establishing how heavily the consumer utilizes transportation-enabled services instead of traveling to accomplish particular goals;

- Measuring the affordability of each mobility service in each population segment of interest;

- Assessing the consumer’s loyalty towards each mobility service utilized and calculate the individual’s lifetime value to that service.

By analyzing Urban Transportation Wallets, a city or an entire metropolitan area can determine the steps it must take in order to succeed in offering transportation as a service. The Consumer’s Urban Transportation Wallet is an important input to these decisions. As one might expect, the Urban Transportation Wallet varies by consumer and by geography. A city’s, and ultimately a country’s, overall Transportation Wallet is very dependent on the state of the public transportation system, the cost of mobility services, and the cost of owning and operating a vehicle. A few examples from our research are shown in the table below. One can see that Germany and France have a transportation wallet that is more evenly distributed between privately-owned vehicles, public transportation, and mobility services than the US’s transportation wallet (where the transportation wallet is dominated by privately-owned vehicles), and Japan’s (where the transportation wallet is dominated by public transportation).

| Country | POVs/1000 | POV Miles/capita | Public Transport rides/user/year | Annual mobility services users (million) | Mobility services rides/user/year |

| US | 800 | 12000 | 40 | 42 | 35 |

| Germany | 561 | 6300 | 177 | 11 | 5 |

| France | 480 | 6200 | 154 | 12.6 | 34 |

| China | 181 | 620 | 108 | 521 | 3 |

| Japan | 615 | 3900 | 246 | 12.6 | 14 |

Cities that are investing aggressively in smart transportation infrastructure, multimodal public transportation, and where mobility services coordinate with public transportation, tend to have lower commute times: Berlin, Madrid, Paris (1 hour/day) and the modalities consumers use is balanced between POVs, public transportation, and walking, compared to Mumbai, Istanbul, Sao Paulo (3 hours/day). New urban mobility will be implemented differently around the world. Depending on how it is implemented it will give rise to 3 different scenarios:

- Co-existence of mobility services with private vehicles and continuously decreasing role for public transportation. This is the likely scenario that we will continue to see in US cities.

- Dominant role of multimodal public transportation, co-existing with on-demand mobility services offered by fleets, and a smaller role for private vehicles. This is the likely scenario for European cities.

- Centrally orchestrated multimodal mobility offered exclusively as a service in certain parts of a metropolitan area, using advanced transportation networks many relying on autonomous vehicles of various form factors, with only a very limited role for private vehicles. This is the likely scenario primarily for Asian cities.

Leave a Reply