The OEMs’ Dilemma with Software-Defined Vehicles

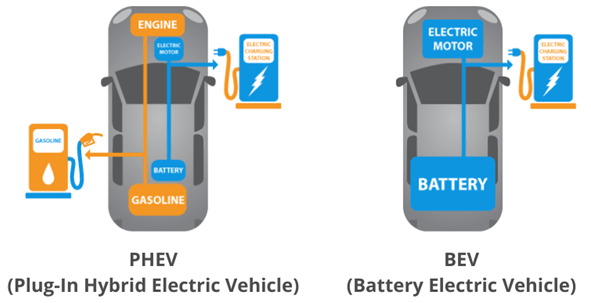

Automakers are facing a complex dilemma relating to software-defined new energy vehicles. Should they proceed with aggressively investing and developing software-defined vehicles while facing a slowdown in demand for battery electric vehicles (BEVs), or continue developing Internal Combustion Engine (ICE) and hybrid vehicles (including plug-in hybrids) that are based on existing architectures and practices?

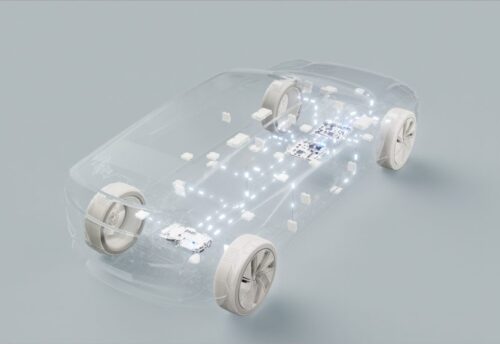

In my book The Flagship Experience I define software-defined vehicles as vehicles whose capabilities are virtualized and managed by software that is running on top of commoditized high-performance hardware, instead of being controlled by dedicated hardware components as is the case in today’s conventional vehicles that are based on microcontroller architectures. Software-defined vehicles differ from conventional vehicles, including the hybrids available today, over several dimensions. They enable continuous improvements and customization of the vehicle and its in-cabin experience through over-the-air (OTA) software updates, support higher levels of driving automation, enhance the vehicle’s performance through the incorporation of intelligent power management systems and interaction with the transportation infrastructure, are easier to manufacture and service because they include fewer parts since the functionality is realized via software, and are big data generators enabling better management and optimization of processes of interest to the automaker, such as customer and vehicle understanding and fleet optimization, and vehicles to be offered with fewer trims among others. These characteristics offer benefits to both the customer and the automaker. For example, OTA updates reduce (and in many cases eliminate) the customer’s trips to the service station and enable customizations that make the vehicle fit its user’s needs. The automaker, among other benefits, profits from having to integrate fewer physical parts which positively impacts manufacturing, and having vehicles that last longer which positively impacts warranty costs.

In an article I co-authored with Stephen Zoepf we argued that the challenge incumbent OEMs faced at the time was due to business models. Companies offering on-demand mobility services, car-sharing, and car subscriptions threatened the vehicle ownership model on which the automotive industry has been built. In another piece I wrote a little over a year ago, at the time when demand for BEVs was surging, I was urging incumbent OEMs to invest heavily in the development of software-defined vehicles even in the face of the significant challenges they were facing from newcomer automakers and Chinese OEMs.

Several events have happened in the intervening period leading incumbents to the dilemma they face today.

Large automakers such as VW, GM, Ford, and others that committed large investments toward developing software-defined battery-electric vehicles found that the technologies involved in these vehicles, including the software stacks and battery systems, were harder and more expensive to develop than originally projected. Today incumbent and newcomer OEMs lose significant sums of money with every BEV they sell. The software they have already released has quality issues leading to product introduction delays and customer dissatisfaction.

OEMs that created separate technology organizations and tasked them with the development of the new vehicles’ software stacks, like VW’s Cariad, realized that the interaction of these organizations with their hardware engineering and manufacturing units was more challenging than originally anticipated. Instead of the software organization leading the development of software-defined vehicles, this remained a hardware-led effort.

Customers, especially non-Tesla owners, started complaining about their BEV experience due to inadequate charging infrastructure, higher vehicle repair costs, and changes in their vehicles’ residual value due to price wars among automakers. Prospective buyers were complaining about the lack of affordable models. During 2023 interest rates continued to rise making vehicle acquisition, the second largest consumer purchase by dollar value after buying a home, harder. This impacted the higher-priced vehicles, including BEVs. Combined with the weak customer experience which spread by word-of-mouth, it has resulted in the slowing BEV demand we now observe particularly in the US.

Last Wednesday, the EPA announced it projects that battery-electric vehicles could make up about 30 to 56 percent of new light-duty vehicle sales. The final rule eases emission limits in the near term, delays stringency beyond 2030, and offers flexibility with hybrid vehicles. EPA’s rules provide OEMs with flexibility on how to meet average emissions limits for 2027-2032. OEMs can comply by boosting sales of plug-in hybrid vehicles in addition to BEVs to reach their desired powertrain mix across the entire fleet. The rule also relaxes the pace at which OEMs must comply in its early years (starting in 2027), and sharply accelerate only after 2030.

Chinese automakers, led by BYD, strengthened their position in Europe with their technologically innovative and low-price BEVs, taking market share from European OEMs. Similar to what happened in the American market in the 70s, incumbent European OEMs don’t yet have competitive BEV alternatives.

For incumbent automakers, software-defined vehicles present a complex challenge. While they have undisputed advantages to the automaker, they require significant capital investment, new skills for their development and manufacturing, and new partners to provide the technologies they incorporate. The advantages over ICE, and even hybrid, vehicles need to be communicated effectively to the customer because they are not obvious. This will require OEMs, and their dealers, to invest in the education of their sales and service professionals. Salespeople must understand how the vehicle’s characteristics give the customer value and convince the prospective customer that the value is significant and enduring. Service technicians must learn how to properly maintain and repair them, to positively contribute to the customer’s experience.

The dilemma that results from this challenge is whether the newcomers, (Tesla, Rivian, BYD, NIO, and others) because of the software-defined vehicles they have already introduced to the market and the ones they have under development will reap benefits that incumbents cannot attain with their ICE and plug-in hybrid offerings and over time the gap between software-defined and conventional vehicles will become so significant that incumbents will not be able to catch up no matter what investments they will be willing to make at that time.

Leave a Reply