AUTOMAKERS MUST PARTNER AROUND BIG DATA

By extensively utilizing data, and paying attention to detail Tesla has changed the conversation on the type of personalized experience car owners (drivers and passengers) should expect from an automaker. In the process, it is building strong loyalty with the owners of its cars who appear willing to support it through thick and thin. Tesla has taken a lesson from Apple, Google, Facebook and Amazon, four companies that obsess about connecting pieces of data and using it to better understand their consumers and tailor their services to provide the right experience. It is this personalized experience that Tesla offers that has allowed it to build a brand that delights its customers. The exploitation of big data that is generated by vehicles, consumers and companies across the entire automotive value chain must become a key competence of all automakers. But as I discussed in previous posts of this series, with the possible exception of GM through its OnStar service, (and here) only recently have started to collect and utilize these types of big data(and here). As a result, they don’t capture data of sufficient scale and they are not best in classyet at exploiting big data. In this post I argue that automakers should accelerate their partnerships with companies that have strong data collection and exploitation DNA as Tesla has already demonstrated is possible. As mobility services are starting to play an increasingly important role in transportation solutions, companies that offer such services become ideal partners to automakers. By partnering with them, automakers will be able to better understand their customers in far greater detail than they do today, as well as mobility services, which threaten to disrupt them. Ridesharing and carsharing companies represent the best initial candidates for such partnerships because these companies a) are collecting and utilizing consumer big data with the same attention and rigor as Apple, Google, Facebook, and Amazon and b) have already collected impressive data sets due to the scale they have achieved. Apple’s just announced investment in Didi Chuxing (and here), in addition to the broad implications to Apple’s services in China, e.g., ApplePay, is a further indication that data partnerships even among companies that are some of the best in class, can be essential for developing next-generation transportation solutions, including autonomous vehicles.

THE ROLE OF MOBILITY SERVICES IN TRANSPORTATION SOLUTIONS

The future of the automotive industry and, by and large, of the entire transportation industry, continues to generate strong debate and differing visions. These range from a future that maintains the status quo of a car ownership-centric world, occasionally supplemented by mobility services, to one that is car access-centric where car ownership is replaced outright by mobility services that provide on-demand access/use of vehicles and multimodal transportation solutions. While the public has come to associate mobility services primarily with ridesharing and carsharing, the sector includes other types of services ranging from navigation, driver analytics, infotainment, electric vehicle charging, multimodal transportation planning, parking, and car repair.

Even if we never attain the full extent of the car access-centric vision, the continued growth of ridesharing services Uber, Lyft and Didi Chuxing and the global scale they have attained leads me to believe that we are likely at least to reach an intermediate state, whereby mobility services will play a central role in transportation solutions. Indeed, we are already almost there. Consumers are starting to expect personalized transportation. Studies from various organizations are already discussing the management of multimodal transportation (and here). Recently, Uber announced a partnership with local transit application Moovit, to allow passengers of public transportation systems to seamlessly go from their originating point to a place where they can catch public transportation and from where public transportation drops them off to their final destination.

Incumbent automakers realize that we are moving towards this new state and increasingly want to provide mobility services and transportation solutions, which they see as a big market, rather than just manufacture cars. Some, e.g., Ford, GM, BMW, Mercedes, have started experimenting with mobility services and begun to invest in relevant startups. Tesla has also hinted they may enter this market. To provide such services, automakers will need to complement their manufacturing knowledge with knowledge about each service of interest and about data. In the process of plotting their course to enter the mobility services market, they will have to determine which types of knowledge and expertise they must and have time to develop and around which they should partner.

Let us now present an example that combines car ownership with mobility services and through it consider some of the benefits derived from a hypothetical partnership between an automaker and a ridesharing company. Most of the times when I go to San Francisco for business meetings I drive my own car to the city’s outskirts, park at the same garage near the freeway, and use Uber to go to my meetings because of efficiency, convenience and cost. I pick up the first Uber ride in front of the garage, and return there at the end of my business day. So, more or less, Uber knows my movements while I’m in San Francisco, along with all my transportation preferences. Through analysis, Uber can infer the duration of my meetings. On my commute to the city I use Google Maps, rather than my car’s navigation system because Google’s routing, traffic information, and dynamic rerouting are better than the information provided by my car’s infotainment system.

Imagine that my automaker has a partnership with Uber. Further imagine that I opt in to allow my automaker to access my calendar and my Uber data. By combining traffic data with my personal data it now has permission to use, the automaker can manage my mobility and offer me a personalized transportation solution for my business trips to San Francisco. Such a solution includes: a) the particular route to take on each trip to the city, b) the location where to park based on traffic at the time of the trip, i.e., I may need to park further outside the city on days where the traffic is very heavy, c) a discount offer for the recommended garage that is nearby to that location, and d) discounted Uber rides to my each of my city destinations in vehicles the automaker manufactures (by having access to my calendar, the automaker can schedule an Uber ride in a car of their brand thus minimizing the wait and, most importantly, keeping my rides within their brand). I could have made this example more complex by including additional types of data, e.g., insurance data, and describing more personalized offers that can be provided based on this richer data set.

My automaker can realize three additional benefits by partnering with Uber. First, the automaker can use the data collected by Uber rides in cars manufactured by the automaker in next-generation vehicles to improve the passenger experience. Remember that while automakers principally think about the driver, ridesharing companies principally think about the passenger. Consider Nissan’s work in designing the NY taxis. Second, by analyzing how many miles/year I ride in the automaker’s vehicles (through my personal car and ridesharing), the automaker can offer me a loyalty program with specific benefits. For example, for every 5,000 miles I receive free cellular data to be used while in my personal vehicle. Such offers, by the way, could lead more consumers to sign up for car data plans, like the Tesla owners are required to do. Third, Uber and the automaker can tie together driver and passenger data, e.g., when I travel to San Francisco I’m a driver, but when I move around San Francisco I’m a passenger, and thus gain a more complete profile of each individual. Having access to such profiles, the automaker can segment each market and understand better the preferences of each segment.

But why would Uber want to partner with the automaker? Let’s consider the prior example from Uber’s perspective. Like an airline does with its planes, Uber always wants to understand which of the vehicles in its service are more efficient and allow for higher utilization, while providing the highest satisfaction to the passengers. Under the partnership, the automaker provides Uber with the performance data collected from each vehicle used during for my rides. Uber uses this data as it attempts to improve the ridesharing operating costs and, as a result, could decide to use for its service more of automaker’s vehicles. This is exactly what GM and Lyft could do as they develop their partnership, following the former’s investment in the latter. Finally, the data collected by the automaker about its car owners, including data collected through the automakers’ concierge services, can be valuable to Uber as it tries to understand how such owners use its service so that it can provide them with better transportation solutions.

MOBILITY SERVICES COMPANIES CONSTANTLY EXPLOIT BIG DATA

The hypothetical situation described in the previous section’s example is only made possible because of the analysis and exploitation of data. GM’s experience with OnStar, and success studies from mobility services companies such as Uber provide further proof that personalized and multimodal transportation solutions require the exploitation of big data and can greatly benefit from the proper exploitation of such data. Mobility services companies in general, and ridesharing companies in particular, are big data and machine intelligence companies from inception. There are three reasons for this claim:

- In the process of conducting business, mobility services companies generate, collect, analyze and exploit big data.

- As ridesharing and carsharing companies are working to reduce their operating costs and better control their pricing, they are collecting and utilizing big data about the vehicles in their fleets. Startups like Zendrive produce additional types of analytics that ridesharing and carsharing companies can utilize towards this goal.

- As ridesharing companies proceed to develop Electrified, Autonomous, Connected vehicles(here and here) in a further effort to control their costs (cost/mile can go from $1.6/miletoday to as low as $0.31/mile with an Electrified, Autonomous car) they are starting to generate and collect new types of big data on which they can apply machine intelligence.

In the course of conducting business on a global basis, ridesharing and carsharing companies capture, analyze and exploit:

- Passenger characteristics and preferences, including credit card data through which they can access a variety of financial and demographic information, as well as behaviors in different contexts, e.g., Passenger A prefers a black car for rides to the airport (travel-related), prefers multi-passenger rides to music concerts (entertainment-related), and prefers regular car rides to meetings (business-related).

- Driver characteristics and behaviors in different contexts, e.g., Driver B belongs to the top 1% of drivers in terms of service provided during trips of 30 miles or more, based on passenger reviews and ratings, and low accident reports.

- Vehicle data, e.g., vehicle breakdowns by make, model and year based on reported incidents.

- Geolocation data, including the starting point and destination of each trip, which they use in order to establish each ride’s price and thus remain competitive with other options each passenger has.

- Traffic data, including road conditions due to repairs and accidents, which they use in order to more accurately estimate the time of the ordered car’s arrival, offer routing instructions to drivers in order to shorten the ride, and provide a better overall experience to the passenger.

- Site condition data, e.g., airport construction projects, parking availability, conditions around event venues, e.g., stadiums, concert arenas in order to improve the passenger experience.

As they experiment with new services, such as on-demand shipping and delivery, ridesharing companies will collect additional types of consumer data, e.g., preferred grocery chains.

IMPLICATIONS

The implications of the multifaceted partnerships that automakers must establish around big data include:

- There will be no single owner of data. The development of a data-sharing culture will require an important adjustment by the automakers that today tend to regard that they own all vehicle-related and driver-related data they capture. They will also need to think about what happens to this data when companies participating in such partnerships fail. Internet companies had to make corresponding adjustments with regards to the data they capture.

- Monetization of the data will remain tricky in the short term. Consumers have shown the willingness to pay for some mobility services, e.g., ridesharing, parking, but not for every type of service. Automakers must exploit these partnerships to identify viable and scalable business models that enable them to monetize on the data they collect and own.

- No room for walled gardens. As the automotive industry opens up to accommodate more mobility services, walled gardens will fail in the same way they failed in the telco industry.

- Better user experience. In the process of accessing personalized transportation solutions and having superior user experiences, customers will need to interact with multiple companies.

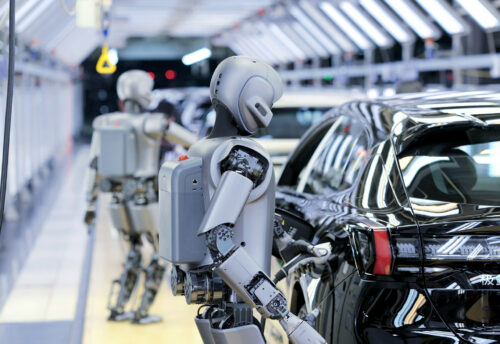

- Rethinking small batch vehicle manufacturing. The data collected by ridesharing and car sharing companies, combined with 3D printing technologies and small, robotized assembly plants can be used to make economically feasible the manufacturing of specialized vehicles, e.g., taxis, logistics delivery vehicles, etc., in small batches. Such vehicles will then be purchased and used by the ridesharing and car sharing companies themselves.

As we are moving from a car ownership-centric to a car access-centric world where consumers increasingly demand personalized transportation solutions, automakers must augment their manufacturing and distribution expertise with broad big data management and exploitation expertise and develop a data-sharing culture. This can be achieved quickly and effectively through multifaceted and strategic partnerships between automakers and mobility services companies starting with those offering ridesharing and carsharing services. If executed correctly by both sides, such partnerships can provide great benefits to all parties involved, create new virtuous cycles and result in high-satisfaction consumer transportation experiences.

Leave a Reply