Five Categories of On-Demand Mobility Services Companies

On-Demand Mobility Services, and particularly ride-hailing, have emerged as a strong option for consumer urban transportation. In the process, ride-hailing has disrupted the taxi and limo industries and could next disrupt public transportation and last-mile goods delivery. Nowhere is this more evident than in cities such as New York and San Francisco. Other mobility services such as shared ride-hailing, and micromobility, as well as various forms of microtransit and car sharing are also showing robust growth. In a previous post I organized automotive OEMs into five categories. Using a small set of dimensions I created a similar structure for the companies offering on-demand mobility services, focusing particularly on ride-hailing services. In this post I present my first attempt to organize these companies into five categories based on how they approach next-generation mobility and the value they offer to their customers.

Introduction

On-demand mobility services is not a new concept. Car rental, as offered by companies like Hertz and Avis, taxi and limousine service, and public transportation provide early manifestations of both on-demand and scheduled mobility services. However, over the past 10 years we have seen new types of mobility services enter the market, as well as the re-imagination of several of the existing services. Zipcar reinterpreted car rental, Uber and Lyft reinterpreted taxi service, Via, and Chariot introduced new forms of ride-sharing, and automotive OEMs such as Daimler and GM introduced new car sharing models with Car2Go and Maven respectively. All these new services recognized the need to offer consumers improved convenience, better overall customer experience, and better pricing options without sacrificing safety.

For example, consider the changes to the car rental operating model. Traditionally, car rental companies like Hertz, and Avis required consumers to go to their own lots to pick up a vehicle. Zipcar, among other innovations, changed the model by determining where to preposition vehicles in order to better match and optimize consumer demand for vehicles with vehicle supply. By doing so, it increased the revenue per vehicle and was able to satisfy its customer demand with a smaller vehicle fleet. DriveNow, Car2Go, and Maven took Zipcar’s model even further. They allow cars to be picked up from any location they are parked instead of pre-determined locations. Finally, companies like Turo made a further refinement to the car rental/ car sharing model. They enable individuals to offer their privately-owned vehicles for rental.

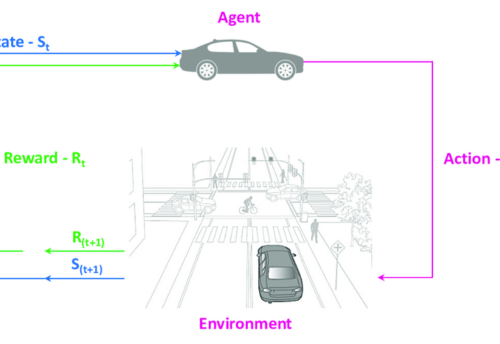

Transportation Network Companies (TNCs), such as Uber and Lyft started by offering single-passenger ride-hailing services. TNCs recruit drivers who supply their own vehicles, and riders. Their data-driven software platforms would coordinate rides by matching drivers with riders, set the ride’s price, manage the ride, and track service ratings. By not owning the vehicles, TNCs can at low cost adapt the supply of drivers to the demand for rides. This is at the core of their business model. Over time TNCs started offering ridesharing services and more recently multimodal transportation as they partnered with or acquired micromobility startups. Some are also incorporating public transportation to the options they offer to consumers.

Analyzing On-Demand Mobility from A Consumer Perspective

Regardless of the mobility service(s) they use, consumers evaluate them along four dimensions:

- Convenience: This is determined by the availability of one or more mobility services to transport a consumer between two locations, and the actions, if any, the consumer has to perform to access the service once a ride is reserved. For example, if a consumer wants to go from San Francisco’s Caltrain train station to the Moscone convention center (a distance of about one mile) they can choose to use a ride-hailing service offering point-to-point, single-passenger transportation, an escooter or bike/ebike micromobility service, or a fixed route microtransit service offering multi-passenger transportation. The ride-hailing will pick up and drop off the consumer exactly at the desired locations. Micromobility and microtransit may require the consumer to walk a certain distance to access the service and to go to the final destination at the end of the ride.

- Passenger experience: This is a more complex dimension. It is determined by taking several factors into consideration. These factors include the overall user experience while interacting with a particular mobility service through its application in order to accomplish a transportation goal, the complexity of the transportation goals the mobility service company can satisfy, the quality of the in-vehicle experience while being transported and the degree to which this experience can be personalized, how quickly the vehicle will arrive once the service is ordered, how fast the transportation will be completed, and how accurate these estimates were. For example, getting from the Caltrain station to San Francisco’s Transamerica Tower (a distance of approximately two miles) during the early afternoon hours in the middle of a week may be faster and cheaper if the mobility service user is willing and able to combine ride-hailing with micromobility, instead of using ride-hailing alone. A company offering this multi-modal transportation option through its application to a consumer that is likely to accept it, doesn’t require the consumer to walk to access any part of the service, and can complete the overall ride in the predicted time provides a better passenger experience because it gets the consumer to the intended destination faster and cheaper than using just ride-hailing.

- Price: Price has been an important factor for the success of ride-hailing services over city taxis. For certain consumers microtransit and micromobility became additional attractive options because of the lower price of the service with only minor inconvenience due to the way the modality operates. While in many cities price parity between taxis and ride-hailing services has been achieved, for many consumers today low prices combined with convenience represent the main factors for using certain on-demand mobility services.

- Safety: For mobility services that are provided using human-driven vehicles (ride-hailing, ridesharing, microtransit, carsharing), safety is established both by the condition and safety record of the vehicle used, as well as the driver’s safety record. In micromobility safety is determined both by the consumer’s riding style and attention, as well as the other vehicles on the road. In the meantime, the number of micromobility-related accidents is growing, and additional ride-hailing safety incidents are reported, the importance of mobility services safety will further increase.

Autonomous vehicles are viewed as critical to the ongoing success of on-demand mobility services. Their use is expected to significantly reduce the operating costs of such services thus improving their profitability prospects, reduce the price of service thus benefiting users, improve safety, provide better passenger experience, and, if optimized effectively, improve the user’s overall convenience. Mobility services companies expect to use such vehicles in single-passenger ride-hailing but also in on-demand ridesharing and microtransit. Initially in geofenced areas and later more broadly. Obviously, not every mobility services company will adopt them and the ones that do won’t be able to use them throughout their operating territory, at least not from the beginning because of the geofencing limitations.

Analyzing On-Demand Mobility from A Business Perspective

Analyzing on-demand mobility services from a business perspective requires more dimensions and a more complex set of criteria. After evaluating startups, established private companies, and the newly established mobility services operations of automotive incumbents like GM’s Maven, Daimler’s Car2Go and Moovel, and others, I decided to use the following six dimensions for this analysis:

- Vehicle type: A large variety of vehicles will be used in the context of next-generation mobility for passenger transportation and last-mile goods delivery. They include conventional ground vehicles with Internal Combustion Engines (ICE) (car, minivan, van), autonomous electrified (ACE) ground vehicles (car, minivan, van), Unmanned Aerial Vehicles (UAVs) including air taxi, delivery drone, and long-haul Vertical Takeoff and Landing (VTOL) vehicles, bicycles (conventional or electric), as well as scooters (conventional or electric, 2- or 3-wheeled). Each vehicle type has its own economics and can be used for different mobility services and in specific territories (see below).

- Mobility service type: We have already mentioned the growing variety of mobility services that have been introduced. From single passenger point-to-point ride-hailing, to ride-sharing/microtransit with fixed routing, ride-sharing with dynamically determined routing, and micromobility. Increasingly, mobility services companies are offering multimodal transportation options, e.g., combining car transportation with micromobility, and even public transportation.

- Company type: Three mobility services company models are emerging:

- Ride coordinators. These are the TNCs we know today, coordinating rides in vehicles owned or leased by individuals who drive them to offer single-passenger ride-hailing, and several forms of ride sharing. Today most vehicles used by such services are conventional. Over time they may be replaced by electrified vehicles. Norway provides an excellent example of this trend.

- Fleet operators. We will see two types of fleet operators. First, operators of fleets that are owned by another company. For example, in the partnerships that Ford is developing with Postmates and Domino’s Pizza, Ford will manage the Domino-owned fleet. Second, companies that both own and operate their fleets. Examples of this model will range from pureplays like Waymo, Zoox, and Amazon, to automotive OEMs like GM. Micromobility companies like CityBike, Limebike, Bird and Spin fall in this category.

- Hybrids. Companies that use a hybrid model. In some areas they operate exclusively under today’s TNC model. In others, they operate both under the TNC model but also by operating a fleet of vehicles. For example, in addition to their TNC operations, Uber and Lyft operate micromobility fleets.

- Business model: Mobility services companies are starting to test subscription-, and various forms of advertising-based business models as complements, or in addition, to the transaction-based models we are familiar with. Over time we will also see the emergence of Passenger Commerce-based models, where rider purchases supplement the transportation transaction revenue, and loyalty program-based models. Subscription models are already offered by some automakers for car sharing services. We may also see business models that combine a subscription with transactions, similar to what we find today in fractional ownership of private jets.

- Operating territory: The service’s operating territory may be one or more of inner-city, suburbs, intercity medium or long-haul transportation, or country to country transportation (in certain geographic areas, e.g., Benelux countries, or parts of Scandinavia).

- Cargo type: We see several options in this area from single passenger-only services, such as what will be offered by various types of ground-based or aerial pods, multiple passengers-only as is the case with microtransit offered using minivans and air taxis, goods-only, that will be offered using vans and trucks, and mixed-mode, i.e., the transportation of both passengers and goods, that will be offered using cars, vans, and UAVs. The last type will be the one most likely used for inner-city and suburb transportation as mobility services companies will look to maximize the revenue-miles of each autonomous vehicle.

Five Categories of On-Demand Mobility Services

When considering the relations between the four passenger-centric dimensions with the six business-centric dimensions that organize the on-demand mobility services companies we first observe that convenience is influenced by the type of mobility services offered, the cargo type that can be transported, the business model used, and the vehicle type(s) employed by the service. Passenger experience is influenced by the type of mobility services offered, the company type, and the vehicle type(s) employed by the service. Price is influenced by the business model used, the types of mobility services utilized, the vehicle types(s) employed by the service, the operating territory, and the type of cargo being transported. Safety is influenced by the vehicle type(s) employed by the service, and the company type because of the level of control it will have on the vehicles providing the service.

Based on this analysis I have created five categories of on-demand mobility services providers. In some cases, there already exist mobility services companies that belong to these categories. In others we expect such services to be created with the introduction of various autonomous vehicle types. To better present the categories and point out the similarities between the airline value chain and the Fleet-Based On-Demand Mobility Value Chain, I provide examples of airlines that have similar characteristics. The five categories are:

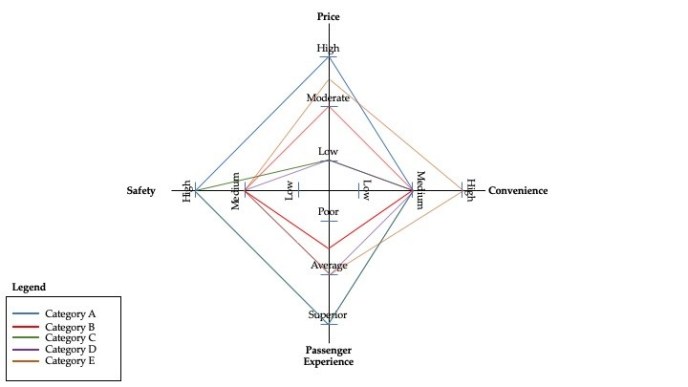

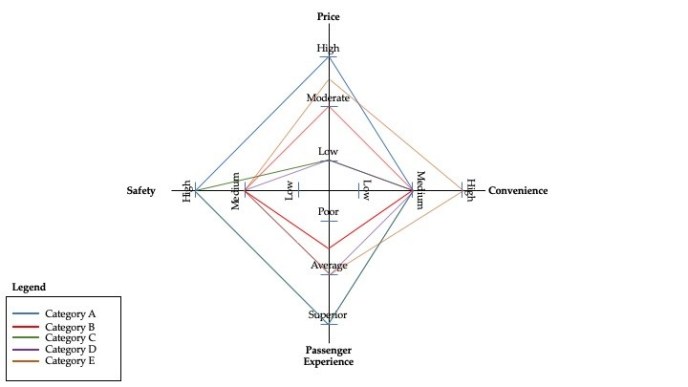

- Category A: Mobility services companies offering high-end service but operate in a small set of areas. These are characterized by high price, superior passenger experience, medium convenience because of limited geographic coverage, and high safety because of their driver selection process, use of new and crashworthy vehicles, and not offering micromobility services that are typically considered less safe. The mobility services offered by high-end automotive OEMs, e.g., Daimler, belong in this category based on the vehicles they use and the customer segments they primarily target. These companies will be fleet operators as they want to completely control the passenger experience. They may use fleets that consist of both human-driven vehicles, or hybrid fleets of both human-driven and autonomous vehicles. This is the Singapore Airlines model.

- Category B: Mobility services offering basic service, provide moderate geographic coverage, and offer average passenger experience. Their services are characterized by moderate prices, average to low passenger experience, medium convenience because of the geographic areas where they, and average safety because their multimodal services include ride-hailing, but also ridesharing using motorcycles and auto-rickshaws. Mobility services companies operating regionally with strong knowledge of the region’s characteristics, such as Grab, Go-Jek, and Ola in Southeast Asia, and Easy Taxi in several Latin American countries, belong in this category. Because of the geographies where they operate, these companies will likely continue to use conventional vehicles for the ride-hailing/ridesharing services and remain ride coordinators rather than become fleet operators. They may partner with the companies in Category E, or they may be acquired by them. This is the Skywest Airlines model.

- Category C: These companies will offer basic service, operate in a small set of geographies, and provide great passenger experience. They will use autonomous vehicles to offer ride-hailing/ridesharing and/or last-mile package delivery services. The use of autonomous vehicles will enable them to offer their services at moderate prices, and because of the extensive use of data and automation they will provide highly personalized passenger experience. However, the use of autonomous vehicles will limit their operation to specific geofenced areas with relatively good weather, leading to medium convenience. But the use of autonomous vehicles will also imply high safety standards. Ride-hailing pureplays such as Waymo, and Zoox, as well as last-mile delivery companies such as Nuro and Starship Technologies are part of this category. In addition to Category A, this is another category where OEMs will participate. For example, GM’s Cruise organization, and Ford Mobility will belong in this category. This was the Virgin America, or Southwest Airlines model.

- Category D: These companies will offer basic service, operate in small areas, with basic passenger experience. They provide ridesharing using shuttles (including autonomous shuttles), or micromobility services. They are characterized by medium convenience because often times the user has to go to specific locations to pick up the vehicle, and medium safety because of the vehicles used, particularly for micromobility. Microtransit services, that may or may not use autonomous vehicles, such as May Mobility, Via, and Voyage, as well as micromobility companies such as Bird belong in this category. This is the Frontier Airlines model.

- Category E: Companies offering high convenience at a price. They operate globally, offer moderate to high priced service because of the fleet types they use and the regulations they adhere to in each country they operate, average passenger experience, and medium safety both because of the way they screen and train their drivers, as well as because they offer micromobility as part of their multimodal service. The companies in this category are more likely to use hybrid fleets of both human-driven and, eventually, autonomous vehicles and offer multimodal transportation options. Hybrid fleets will help them operate globally, increase their profitability at a reduced price/mile, improve the customer experience, achieve a good safety record, and effectively address demand elasticity (in other words, so that they can respond to peak demand without building overcapacity). In addition, they are the most likely to offer both consumer transportation and last-mile goods delivery, e.g., as Uber already does with UberEats. Global ride-hailing companies like Uber, Lyft, and Didi are the best examples of companies that belong in this category. This is the United Airlines model.

The characteristics of these categories are summarized in Figure 1.

Figure 1: The five categories of on-demand mobility services companies

Observations

By analyzing these categories, we arrive at the following observations:

Observation 1: On-demand mobility services companies must continue investing heavily for the foreseeable future. To date mobility services companies have been investing heavily in driver and passenger acquisition, demand generation, and technology development for their software platforms. However, operating fleets to support micromobility, various forms of ridesharing, as well as incorporate autonomous vehicle fleets will require larger investments for vehicle acquisition, technology development and acquisition related to fleet operations, as well as talent acquisition, i.e., hiring people with specialized skillsets such as fleet operations and management. As companies like Uber and Lyft are quickly finding out, their software prowess that allowed them to develop state-of-the-art systems for ride coordination does not automatically translate to leadership in autonomous vehicles technology, or fleet operations. They needed to hire new teams of autonomous system specialists, sometimes via acquisitions, and continue to expand them aggressively. These companies will need to continue ramping up their technology investments to develop systems for fleet optimization, e.g., balance vehicle demand with the supply available vehicles including autonomous vehicles, revenue optimization, e.g., maximize passenger revenue-miles, etc. Finally, their innovations must always try to address traffic congestion and pollution reduction.

The cost of available capital will determine the rate at which these services continue to proliferate and adopt autonomous vehicles. Private companies offering mobility services had little trouble raising large sums of capital to accelerate their geographic expansion plans but also their technology investments. Similarly, incumbent automakers and their suppliers have used profits from certain operations to fund their autonomous vehicle efforts. However, as the cost of capital increases, mobility services companies of every category will be forced to make choices. They will have to determine in which territories they will be able to operate profitably, what vehicles to use, and what business models to use, implying that they may need to constrain their expansion plans.

Observation 2: Transportation, communication, and electrification infrastructures will also require large investments to address the needs of autonomous vehicle fleets. While many on-demand mobility services companies consider autonomous vehicles as a means to address several issues, the breadth of the autonomous vehicle adoption by such companies will be dependent on the state of the transportation (roads, bridges, etc.), communication, and electrification (power generation, power distribution grid) infrastructures in the areas where such services are deployed. Places with poor infrastructures will not be selected by the companies that want to offer such services using autonomous vehicles even if these areas have many of the other important characteristics such as high population density, favorable weather, etc.

Updated transportation and electrification infrastructures are also necessary for the safe and scalable operation of micromobility fleets, as well as of electrified vehicles that are part of any TNC or other mobility service.

Mobility services companies can draw consumers away from public transportation. Under such conditions, cities may have to select how much to invest in their transportation infrastructures and how much on their public transportation networks. Public transportation systems globally are perennially subsidized and underfunded. Additional funding reductions will lead to major degradation of already sparse service. As public transportation services degrade, certain consumer groups, for example those living in outlying suburbs or rural areas, may find themselves with no options as they may not be able to afford on-demand mobility services while public transportation does not serve them. The broader adoption of on-demand mobility services must ensure that public transportation will remain a key component of the system. Public transportation provides the largest capacity for moving people and must be accessible to all citizens regardless of financial means.

Observation 3: The business models of on-demand mobility services companies are still in flux. The business models that rely on the economics of autonomous vehicles are evolving and will continue to do so for the foreseeable future. Many are incomplete, have many open issues, and make assumptions that have not yet been validated. The costs of many on-demand mobility services will remain uncertain or unknown until the autonomous vehicles expected by these services are deployed at some scale. This is not expected before the middle of the next decade and will likely vary by location.

Observation 4: OEMs offering on-demand mobility services must carefully select their fleets. The OEM-owned mobility services companies, like GM’s Maven, Daimler’s ReachNow, and VW’s Moia will be expected (or at least be pressured) to utilize exclusively vehicles that are in the parent’s model lineup. For example, today Maven uses a variety GM models in its carsharing program (Chevy, Cadillac, etc.). In order to be profitable and strongly adopted, the OEMs operating these services must carefully match each fleet’s configuration to the areas where the fleet will be deployed. For example, small luxury cars in congested areas, full-size sedans for airport service. On the other hand, the OEM-owned mobility services organizations in Category C such as GM’s Cruise must think about which vehicle will provide them with better economics. For example, should GM’s AV technology be installed on a Bolt, a small vehicle that could make ridesharing less comfortable, or on an electric Cadillac SUV?

Observation 5: Addressing urban congestion will require extensive use of multimodal transportation and ridesharing. As the popularity of on-demand mobility services continues to increase, it often leads to increasing congestion. We are already facing this problem in cities like NY and San Francisco. Ride-hailing companies may be forced to offer more ridesharing services rather than single passenger services and promote multimodal transportation including the use of public transportation. More ridesharing, as well as use of autonomous vehicles by ridesharing services will require consumer education (see below), since it could also lead to lower transportation prices, but also lower convenience, and sometimes even lower safety. When using autonomous vehicles congestion may lead to longer rides (both in terms of distance covered to arrive at the desired destination and the time it takes for the trip to complete). Longer rides, whether because the vehicle is stuck in a congested area, or because of re-routing to avoid congestion, could negatively impact passenger convenience and the overall transportation experience. Finally, to alleviate congestion cities may start imposing various forms of surcharges, e.g., congestion pricing, that will negatively impact the business models of the mobility services companies.

Observation 6: Consumer education will be necessary. Consumers across many segments and geographies will need to become convinced of the benefits offered by ridesharing, autonomous vehicles in general, and the spectrum of on-demand mobility services that utilize such vehicles in particular. For example, while Millennials may feel more comfortable with autonomous vehicles, Baby Boomers do not. This education must address consumer anxieties relating to the use of such vehicles (the technology works correctly all the time, not most of the time; there are both short-term and long-term benefits from using autonomous vehicles), and any issues relating to the potential job losses because of the employing autonomous vehicles for a variety of services.

The on-demand mobility services companies, together with the autonomous vehicle manufacturers and suppliers, must also address the public’s anxiety relating to cybersecurity and data privacy risks. The public must understand how safe the vehicle is. For example, can the vehicle be hijacked by hackers while a consumer is being transported? It must also understand what data is being collected and for what purpose it is being used. This means that the public may also need to understand in some detail a company’s business model, and how data impacts it. Only once the public feels positive about how these issues are addressed, they may feel comfortable consistently utilizing autonomous vehicles for on-demand mobility services.

Companies providing on-demand consumer transportation must constantly evaluate whether their service can be offered safely and reliably in the cities that have strong financial opportunity for such a business, e.g., San Francisco, NY. As it turns out, these are also the cities with the most challenging traffic environments where autonomous vehicles have the most trouble.

The next article in the series.

The previous article in the series.

Leave a Reply