Yearend Thoughts on Enterprise AI

In my second yearend post, I write about enterprise AI from two perspectives. As a venture capital investor with an all-AI startup portfolio. As a corporate advisor helping enterprises apply discriminative and generative AI.

The biggest venture financing rounds during 2024 involved AI companies. About $30 billion was invested in companies developing foundation models. To cap the year, just a few days ago, Databricks, a company that will end the year with a $3 billion run-rate but still unprofitable, raised $10 billion in a round that valued the company at $62 billion, and Perplexity raised $500 million at a $9 billion valuation.

Reviewing the characteristics of such financing rounds, combined with the performance of our portfolio startups, and our firm’s corporate advisory AI projects (completed and ongoing), I worry that venture investors expect corporate AI adoption will be fast and large-scale. In contrast, corporate AI spending, though growing, is more measured than VCs predict.

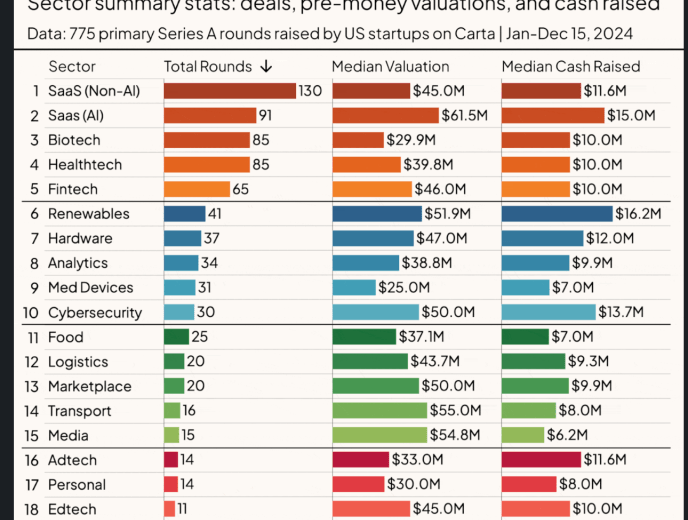

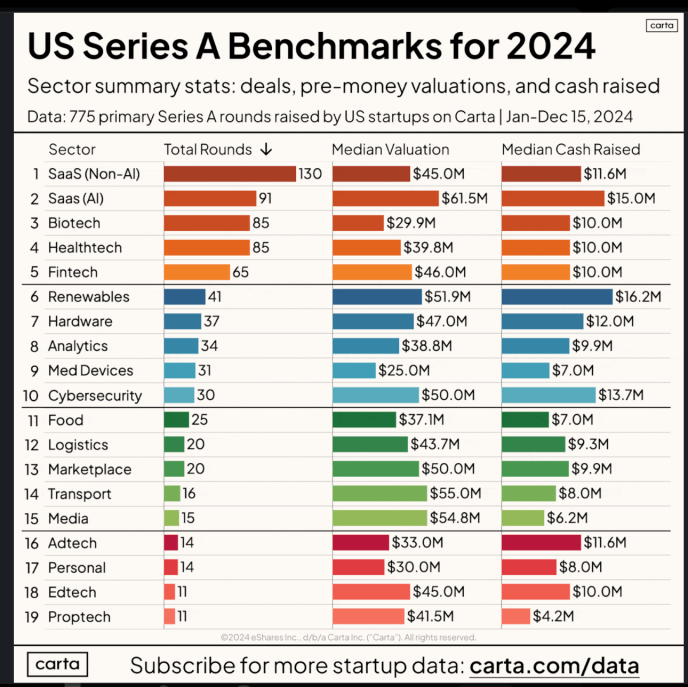

Valuing AI Startups

When we value startups developing AI solutions to address a particular problem, e.g., AI solutions for fleet management or inventory management, we blend two types of data. First, since our firm invests exclusively in startups developing enterprise software AI solutions, we constantly monitor the AI market’s projected size, annual growth rate, and the percentage of the corporate budgets allocated to AI. This data is collected through various analyses and surveys conducted by industry and investment banking analysts, and management consulting firms. We call this the “expected corporate AI spending.”

This data allows us to determine the AI market’s year-over-year growth and understand which industries AI is a high priority for. Though valuable, we find the industry analysts’ market-sizing models and survey respondents invariably optimistic. We try to validate the AI market’s size and growth rate trend whenever we can, from the relevant data incorporated in press releases and quarterly reports issued by public companies.

Second, we consider the actual total amount each of our corporate clients and partners, as well as those of our portfolio companies, spend on AI during a given year. We call this the “actual corporate AI spending” because we have a direct view of it. Our business and that of our portfolio companies are affected by it.

We anticipate a difference, a delta, between the expected and the actual. We make new investments in AI startups as long as over a period the delta remains stable or is decreasing because the actual is higher than expected. However, over the past couple of years, as AI burst again into the scene, venture investors have been investing in many AI startups, including those mentioned earlier, using valuation levels we haven’t seen since the dot-com era. Case in point. In the dot-com period, IT budgets were growing by 10 percent a year. Recent CIO surveys show that IT budgets for 2025 are growing modestly (2.5-3 percent above the 2024 budgets depending on the survey). AI, while one of the top initiatives, is not the top initiative. Cloud-based enterprise software and cybersecurity software remain at the top.

The Reasons for Slower AI Adoption by Enterprises

Where do venture investors base their optimism about AI? There is no question that corporations have increased their AI efforts since the beginning of the year as they continue to investigate how to integrate these technologies into their existing workflows, as well as develop new, AI-first workflows. They may also be thinking that AI startups will face less regulation, enabling them to enter markets faster and require fewer employees to scale. This is not yet the case. The employment of AI startups getting funded continues to follow the pattern we have seen in generation after generation of startups.

I believe companies of any size will use AI in every aspect of their business. Otherwise, I wouldn’t have co-founded Synapse Partners. However, with the benefit of my 40+ years in the field, and without taking anything away from the capabilities of generative AI systems, I predict that the enterprise’s AI adoption will be slower than expected. The adoption will continue and, hopefully, accelerate. According to a recently published Goldman Sachs survey only around ten percent of the the surveyed corporations, particularly those in service industries, currently use AI routinely. The Boston Consulting Group reports that only twenty-six percent of surveyed corporations have an AI strategy.

Today, contributors to slower AI adoption include:

- The lack of an appropriate use case. We see software development, customer support, and document summarization as cross-industry use case opportunities. However, even though these use cases are adopted by financial services and insurance companies, it is not equally important to every industry.

- The condition of the enterprise data (both in terms of hygiene and labeling) to be used for the fine-tuning of foundation models or other third-party LLMs.

- Uncertainty about the quality of the results generated by the AI models. Over the last year, the accuracy of foundation models has increased dramatically on general-purpose tasks. However, enterprises require deterministically accurate results in every task where they apply AI.

- Convincing evidence that AI solutions, particularly solutions that are based on generative AI, provide compelling ROI and time to value given the high costs of these solutions. The per-token cost has decreased dramatically over the last year, but enterprises still realize that when all AI-associated costs are considered, they remain high making it difficult to easily establish a compelling ROI for faster and broader adoption.

- Most enterprises are still transforming to fully adopt cloud computing. Broad adoption of AI will require a new transformation cycle, including a transformation of their technology stack. They are not yet willing to undertake the new cycle until the first four reasons are addressed.

- Cybersecurity related to data and third-party models, together with AI governance and observability, are thorny issues that enterprises need to address comprehensively.

- The rapid advances in the foundation models’ capabilities are often acting as a decelerator rather than an adoption accelerator. Corporations are not expediting the transition of their prototypes to production systems, preferring to wait for additional developments that may be even more impactful to their business.

The next twelve months will be crucial for AI in the enterprise. During this period, generative AI’s early adopters must transition their experimental systems to production and prove they deliver a strong ROI. Such proof will motivate the early majority to embrace the technology and over the next five years develop appropriate strategies, identify suitable use cases, and implement the necessary intelligent systems. It will also enable investors to establish a more realistic technology-adoption horizon. Only then will the optimism that fuels venture investors to support AI companies at unreasonably high valuations today be justified, and those of us who currently remain on the investment sidelines will regret the opportunity we’ve missed.

Leave a Reply