The Three Cultures Impacting the Automotive Industry

Recent automotive industry news made me realize again that the road to new mobility will not be a straight line. The twists and turns we encounter and will continue to encounter, will come as the result of economics, business models, industrial policy, politics, national security, but also culture. Mobility is impacted by at least three cultures: the automakers’, the dealers’, and the customers’. The customer culture further influences both the vehicles they acquire and use, as well as the broader mobility characteristics of the places where they live. The three cultures exhibit different dynamics in each geographic region. This is the reason new mobility is not adopted uniformly around the world.

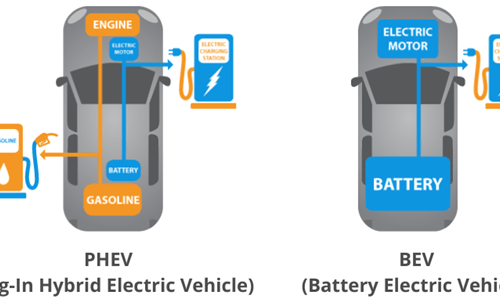

The mobility market is experiencing significant changes yet again. Interest rates have remained stubbornly high negatively impacting vehicle financings. Today customers expect again to be presented with incentives before they acquire a vehicle. Range anxiety and inconveniences associated with charging stations are leading people to reconsider their interest in Battery Electric Vehicles (BEVs). On several occasions, automakers, starting with Tesla, decreased the prices of their BEVs to motivate sales. Based on the reported data, the discounts didn’t always have the desired effect. Furthermore, because they negatively impacted the residual value of previously acquired vehicles, they ended up upsetting existing BEV owners.

Dealers face a demand-supply mismatch. They don’t have enough conventional and hybrid vehicles to meet demand but have too many BEVs which they often have to sell at a loss. Dealers never warmed up to the idea of offering software-defined new energy vehicles, starting with BEVs because of the investments they had to make, and the changes to their business model the sale of such vehicles requires.

Because of the market conditions, automakers are re-evaluating the investment and development strategies they announced just a short while ago. They now realize that under these market conditions, large investments to create vertically integrated supply chains for software-defined BEV model lineups will not be recouped easily, if at all. As a result, they are slowing down their expansion plans and, in some instances, eliminating them. Automakers can address the emission regulations with hybrid vehicles and governments, with some pressure from labor, are accommodating them in a variety of ways. On top of that to protect domestic automakers, the US imposed high tariffs on Chinese BEVs, and the EU is exploring similar measures.

The twists and turns that characterize the road to new mobility, and ultimately its success or failure, will depend on the automaker, dealer, and customer cultures each of which will incorporate regional characteristics but all three of which are interdependent. In my new book The Flagship Experience, I explored in detail the automaker culture but later I realized the importance of the other two particularly in shaping how software-defined vehicles, new energy or conventional, will be incorporated into new mobility. Which one group does have a direct impact on the other two? To the three cultures, we will also add organized labor as a fourth, but for now, we can leave that aside and focus on the first three.

- The customer culture. This can be considered the most whimsical and volatile of the three. Two years ago BEV sales were on fire. Newcomers like Tesla and Rivian were scrambling to increase production. Incumbents were rushing to develop new software-defined BEV models. Late last year, BEV sales started growing slower and even flattening. The customer culture is also extremely regional. The California customer culture is very different from that of Texas, Germany, or China. When new energy vehicles are concerned, the Chinese want technologically advanced vehicles that can be customized and differentiated. As such, they have embraced software-defined BEVs. Europeans want reliability at a low price. They don’t look for their new energy vehicles to necessarily have cutting-edge technology, e.g., be software-defined, as long as they are affordable. They may prefer less technology to protect their privacy. Americans need to be considered on a state-by-state basis. Californians are more sensitive to the environmental impact of their vehicles while Midwesterners prefer vehicles that can travel longer distances, require little thinking about their operation, and have low-cost maintenance.

- The dealer culture. This is considered the most conservative and resistant to change of the three. It is characterized by always trying to maximize returns with no, or the bare minimum, investment. Dealers are trying to protect/preserve their existing business model even as the industry consolidates from the neighborhood dealer to the large corporation e.g., AutoNation, preferring to sell conventional Internal Combustion Engine (ICE) vehicles under the long-established models. They realized that the sales of software-defined new energy vehicles would require them to invest in the education of their salespeople and technicians, as well as add to the infrastructure of their dealerships. At least in the US dealers don’t understand why automakers keep pushing them to make such investments without the overwhelming demand from individual and fleet customers. Indeed, OEMs have not yet made a compelling value proposition to their customers convincing them of the need to own software-defined BEVs. Dealers have not been eager to sell software-defined BEVs because of the negative impact they will have on their business. The customer can add new options to the vehicle through Over-The-Air (OTA) updates, depriving the dealer of what is today a big monetization opportunity. Software-defined BEVs provide fewer opportunities for service than conventional vehicles and many of these can be addressed also through OTA updates.

- The automaker culture. Automakers have a culture of short-termism. One can say that this is not unique to the automotive industry. However, because of the changes brought upon by new mobility, the automotive industry cannot maintain this culture. On top of that, and as I point out in The Flagship Experience, organizationally automakers remain hierarchical and inflexible while they have to kowtow to both the customers and their dealers. There is no other explanation for why incumbent automakers initially ignored BEVs (software-defined or otherwise), then jumped with big pronouncements and strategies that required huge investments, and now they’re moving away from them preferring to focus on hybrids while announcing large buybacks that reward their shareholders but limit their ability to innovate. The automakers’ short-termism culture negatively impacts their ability to build software-defined vehicles that rival those of the newcomers, particularly their Chinese competitors. It remains to be seen whether their efforts to establish direct-to-consumer models remain on track or change as well.

Embracing new mobility requires radical transformations that all three cultures will need to undertake. Customers will need to understand the impact of their mobility choices and everyday mobility behaviors. Automakers must realize that their technology transformations are not sufficient and must be quickly augmented with business and culture transformations. As automakers adopt direct-to-consumer business models to better address their customers’ needs, and introduce software-defined new energy vehicles, dealers will need to undergo a cultural change to find their role in the new mobility ecosystem.

Leave a Reply