Software-Defined Vehicles Need a New Customer Experience

During the last twenty-five years, the automotive customer journey has become more complex. Incumbent automakers have tried to become more involved in various stages of the customer journey to improve the customer experience and establish a direct relationship with the customer. Software-Defined Vehicles will enable a richer and more personalizable experience. When designed properly such an experience will lead to better customer relations and recurring post-sale customer monetization.

Until the Great Depression, it was common for the rich to purchase a rolling chassis from an automaker and then go to a coachbuilder to develop a car that reflected their ideas of luxury, performance, or any other characteristic they wanted to showcase during driving. Creating bespoke bodies and cockpits on premium chassis evolved into another practice that emerged before the Great Depression in the US, that of the contract builder. The small-batch production of luxury vehicles introduced the broader market to the flagship vehicle concept. In the 1930s Alfred Sloan, then CEO of GM introduced the brand ladder that led to the establishment of the flagship brand, which in GM’s case was Cadillac, representing the pinnacle of the company’s design and engineering prowess. Over time, each brand on the ladder developed its own flagship vehicle, a practice that continues to date. For Cadillac today is the Escalade V-Series, whereas for Chevrolet it is the Silverado ZR2. The flagship vehicle provided the design cues, or even design language, for the automaker’s entire model lineup.

Before the broad adoption of the Internet, the flagship vehicle figured prominently in print, radio, and television advertising, and auto shows to attract prospective buyers to dealer showrooms and keep existing customers loyal to the brand, and the manufacturer’s family of brands. For about sixty years, well into the nineties, the customer journey was simple and linear, with well-defined participant roles and clear handoffs. The automaker was responsible for generating awareness, and favorable opinions about the model lineup by creating information about the vehicles and the various trim levels, and communicating it through advertising channels, auto shows, and its dealer network. The prospective customer was a passive participant in the awareness stage. The dealer was responsible for consideration, intent to purchase, purchase, and service, i.e., helping the customer test each candidate vehicle, convince him to acquire one of the vehicles available in the lot, work out financing options, service the vehicle, and sell parts. The dealer was the interface to the customer, while the OEM remained – and remains, with few exceptions – at arm’s length from the customer.

During the last twenty-five years, the automotive customer journey has become more complex. Incumbent automakers have tried to change their role by becoming more involved in the consideration and purchase stages of the customer journey to improve the customer experience and establish a direct relationship with the customer. For example, GM’s Saturn brand had introduced the no-negotiation sales price at that brand’s dealer network. OEMs started offering various post-sale services including concierge services and remote vehicle diagnostics features. GM’s OnStar was the first such service. More recently automakers introduced branded mobile applications. Their adoption has been poor. Even though they enable the user to access the vehicle’s features, e.g., unlock the doors, or start the engine, the experience they support is often disjointed from the overall customer journey. Users find third-party mobile applications for parking, gasoline price comparison, vehicle servicing and repair, and others to be functionally better than the OEMs’ mobile applications.

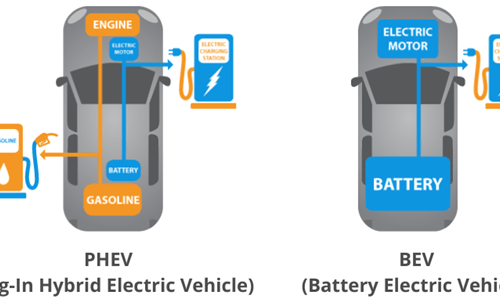

New mobility is the movement ability to move people and goods using a coordinated combination of alternative powertrain vehicles that are intelligent and connected, and transport services that are offered on a scheduled or as-needed/on-demand basis.

With new mobility, the customer journey becomes even more complex and less linear for three reasons. First, new mobility is introducing new ways to move, and vehicles that utilize alternative powertrains and new technologies. Software-Defined Battery Electric Vehicles are one such example. Purchasing a private vehicle warrants the consideration of different alternatives during the customer journey. Second, digital retailing now supports a variety of vehicle acquisition paths (OEM, dealer, third-party sellers). Its growing adoption necessitates that these paths be part of the customer journey and provide cues to the OEM on what they should do during the journey’s pre-sale steps. Third, before the advent of new mobility, the customer experience was about buying the vehicle. The focus was on the vehicle. The overall customer experience was designed as one of the last steps of introducing the vehicle. Under new mobility, the customer experience is about ownership and use. The focus is on the customer. The customer journey must reflect that change. It should be designed as one of the first steps. As Katharina Seifert, Head of Volkswagen’s Group Engineering Strategy states “Customer experience shouldn’t be reduced anymore to the in-car interaction areas but should be thought of as a concept to optimize all customer touchpoints, including the services provided to the customer and the vehicle.”

Multimodal mobility is becoming a feasible alternative in many cities around the world. Customers want to understand how their choice of a new Software-Defined Battery Electric Vehicle will fit with all the mobility options that are available to them. As a result of these considerations, the incumbent OEM business model that relies on

- the flagship vehicle’s appeal,

- the vehicle features that are determined by product planners, and incorporated at the time the vehicle is manufactured, and

- the OEM making their money at the time the vehicle is sold

is no longer relevant or cost-effective. This approach is detrimental to the automaker that either must increase the vehicle’s price or absorb each feature’s cost and to the customer that has to pay a higher price for the vehicle even though they may never receive any benefit from these features. The business model provides the OEM with one-time revenue at the time of the transaction, in the case of a sale, or with a fixed recurring revenue in the case of a lease, plus some revenue from the sale of original replacement parts to the dealer. But does not allow the automaker to optimize the total revenue opportunity and capture its upside by participating in any improvement in the customer’s lifetime experience and value. For example, the financial benefits that are coming from an upgrade of the vehicle’s infotainment system, or its engine’s performance. Moreover, because a Software-Defined Vehicle can be personalized primarily through software updates, the new customer experience must consider all subsequent owners of the vehicle and not only the first. To protect various interests, agreements, and norms, there have been few attempts to start with a clean sheet and redesign the customer experience and the associated customer journey.

The existing customer experience associated with the conventional vehicle ignores the ecosystem of insuring, fueling, servicing, and repairing such vehicles. For example, when considering whether to purchase or lease a battery-electric vehicle, the customer has also to identify a suitable provider of home chargers so that they can charge their vehicle while they are at home and determine how to receive a rebate from the government for having such a vehicle. Today, these are three disjointed customer journeys. Imagine the customer’s delight if the vehicle’s OEM were to connect them and provide a simplified customer experience.

As we advance along new mobility phases, and new capabilities are incorporated into vehicles, e.g., driving automation, the automotive customer experience, and the associated customer journey need to be and can be, re-imagined. In re-imagining it, the OEM needs to reflect how they want their brand to be perceived and how to monetize the customer beyond the vehicle sale. The new customer experience must:

- Be simple but incorporate all the elements of vehicle ownership.

- Enable direct, personalizable, and value-added interactions relating to the safety, affordability, and convenience of the customer’s mobility, while taking into consideration the customer’s constraints and preferences.

- Optimize the monetization of the customer’s lifetime value in a way that is consistent with the vehicle’s Total Cost of Ownership (TCO).

- Protect the customer’s privacy and cybersecurity.

This re-imagined customer experience, which we call Flagship Experience, should position the automaker as the customer’s mobility partner, and not simply as a vehicle provider. The Flagship Experience must present the most innovative mobility capabilities the OEM and its partner ecosystem can offer throughout the customer journey, just like the flagship vehicle offers the automaker’s best vehicle technologies.

Leave a Reply