ORDER THE FLAGSHIP EXPERIENCE

“Automakers have gotten by for a century delivering incremental technological change on long product cycles while outsourcing customer relations to dealers. That strategy is doomed. In The Flagship Experience Evangelos Simoudis tells you why, and what legacy automakers must do to survive. Every business leader can learn from this.”

“Similar to how the electric vehicle revolution became the mobility story of this decade, the Software-Defined Vehicle revolution will be the story of the next decade and beyond. It will get local, state, and federal governments to zero fatalities on their roadways, and smart transit solutions to every city—big and small, rich and poor. The Flagship Experience eloquently articulates how the present will inspire the future, and how every citizen of humanity can benefit from this new technology.”

“The Software-Defined Vehicle, enabled by AI, opens new ways for automakers to delight their customers. With the right service and business model, it can create additional revenue opportunities along the lifecycle. The Flagship Experience presents an easily digestible framework for the automotive industry to achieve the full potential of digital technology investments.”

As embodied AI becomes the next AI frontier, it forces a sobering reality check for employment in the American automotive industry. Reviving the auto industry and bringing back two million manufacturing jobs collide with the reality of stagnant demand for new vehicles, software-defined vehicles that are easier to manufacture, and

As The recent CES provided a powerful showcase for humanoid and other adaptive robots. The demonstrations served as an important reminder that embodied AI is the next AI frontier. Beyond the technology challenges that remain before conquering this frontier, how should we view embodied AI? Will it be the cause

As 2025 drew to a close, the narrative surrounding enterprise AI began to shift. We moved from 2025 being the “Year of Experimentation” to 2026 shaping as the “Year of Deployment.” Under such a mandate, enterprises must develop and deploy their AI applications scalably, efficiently, and economically. For the large

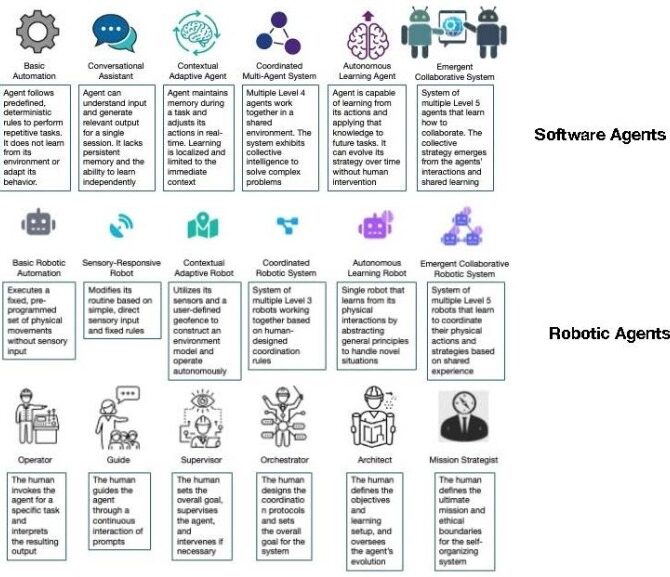

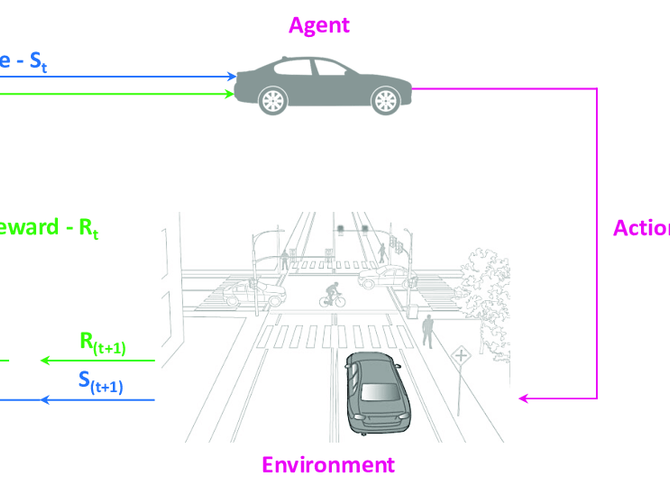

Enterprises have accelerated their efforts to integrate AI into operations. More recently, many have launched pilot projects to develop agent-based systems across various domains. Most of these agents rely heavily on the capabilities of conversation-centric foundation models such as GPT or Gemini. But as we deploy more capable agent-based intelligent

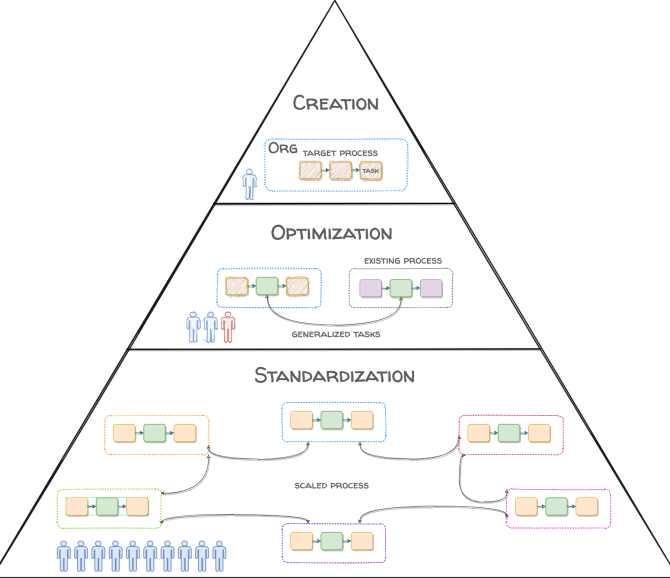

As AI agents become more capable, how should the roles and responsibilities of the AI-first enterprise employees evolve? Which skills will matter at each level? How will technical and business teams collaborate to effectively leverage agents and agent-based systems? As the capabilities of agents advance, employees will move from executing

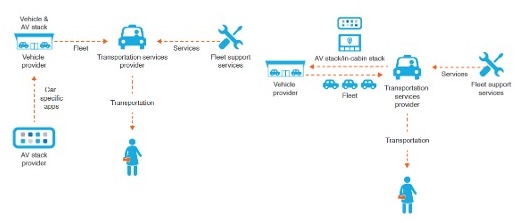

The global robotaxi industry has entered a new era, one defined by the tangible formation of new value chains. The recent flurry of high-stakes partnerships and strategic pivots is not a sign of chaos, but rather the methodical construction of the very operational and economic structures required for autonomous mobility

In the piece Agents in the AI-First Company I introduced a five-level spectrum for understanding software agents. The piece generated a strong response and valuable comments, for both of which I’m incredibly grateful. Some readers questioned the original progression of the spectrum. They noted that developing agents that can collaborate

AI agents are an important component of the transformation to become an AI-first company. Corporations undertaking this transformation must understand where and how to incorporate agents and which agent types to utilize in the AI-centric processes they establish and the organizational structures they adopt. The article presents AI agent types,

Introduction In today’s corporate digital transformation landscape, “AI-first company” is emerging as a term that deserves real attention, not just another consultant’s buzzword. But can an incumbent truly transform to become AI-first, as Intuit is attempting, or must it be designed that way from inception, like Tesla? In my previous

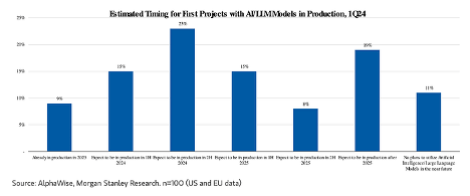

The business world is buzzing with AI experimentation. However, a structured approach for moving from experimentation to production, although necessary, is often lacking, which hinders AI’s transformative potential. This article introduces a decision-support framework, implemented as a decision tree, to help executives mitigate the risks associated with decisions relating to

I recently participated in an on-stage discussion about the state of autonomous mobility at the Ride AI Summit in Los Angeles. During the event, I engaged in several conversations with other participants about the robotaxi customer experience. The essence of these discussions reaffirmed what I’ve long maintained—customer experience, rather than

Ten years ago, I explored the process of insight generation. I presented its key stages and emphasized the characteristics distinguishing true data-driven insights from mere correlations. While the foundations of insight generation remain relevant, since the publication of my original article, the methods, tools, and implications have expanded dramatically. Generative

AI, generative or otherwise, holds immense promise for enterprises looking to improve efficiency, enhance decision-making, and unlock new business opportunities. Yet, despite the enthusiasm, many companies struggle to transition from pilot projects to large-scale AI deployments. The path to effective AI adoption is not as straightforward as acquiring technology or

AI’s allure is undeniable, and businesses invest heavily in its promise. Bain & Company reports that companies today invest an average of $5 million annually into generative AI initiatives, with some even exceeding $10 million. This pursuit is fueled by AI’s potential to improve productivity, cut costs, and unlock new

Just before the holidays, I was asked to keynote an event sponsored by the German American Chamber of Commerce. This article is an updated version of that presentation. It is even more relevant today following CES 2025 and the news streaming out of Europe. 1. Introduction In 2019, I co-authored

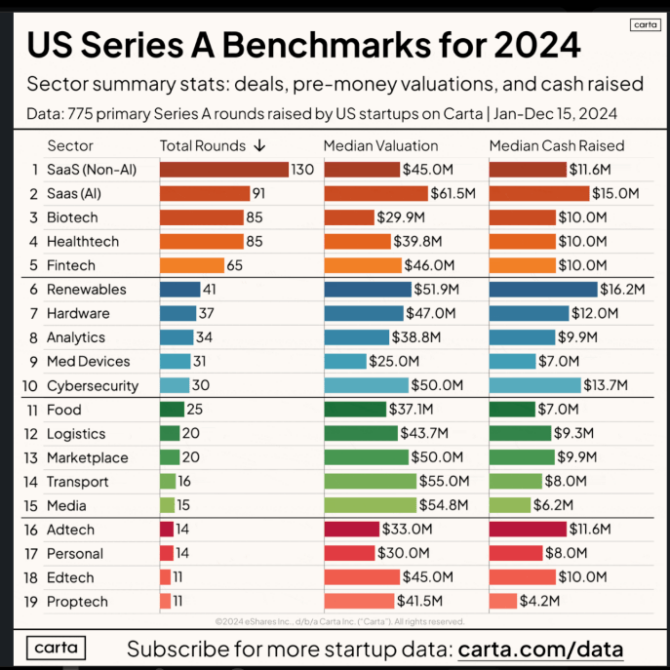

In my second yearend post, I write about enterprise AI from two perspectives. As a venture capital investor with an all-AI startup portfolio. As a corporate advisor helping enterprises apply discriminative and generative AI. The biggest venture financing rounds during 2024 involved AI companies. About $30 billion was invested in

A couple of days ago, while maintaining my website, I realized that I hadn’t written a new blog post for over two months. It’s not that I haven’t been writing. I published several invited pieces relating to my new book and am currently working on a piece about the European

Many of you know our firm for its investments in early-stage AI software startups and as a trusted AI advisor to corporations. However, fewer are aware of the AI systems we’ve been developing and how we deploy them with our corporate clients or in the startups we create. In recent

A few days ago I attended the strategy meeting of a portfolio company. Like all of our Synapse Partners portfolio companies, this one provides AI solutions to enterprise customers. Their initial success is in the medical devices industry. While reviewing the company’s sales pipeline and the progress of delivering the

AI solution providers and infrastructure providers committed to spend $1T on AI-related capex over the next few years, in anticipation of high demand for and heavy use of generative AI enterprise solutions. A few years ago, the automotive industry committed similar scale investments toward the development and deployment of battery

Of the many autonomous vehicle (AV) use cases, two continue to receive the most attention: robotaxis and autonomous trucks of various form factors. AI is one of autonomous mobility’s key enabling technologies. To achieve the determinism required in mobility, the AV software platforms in use today incorporated a combination of

Despite the noise from high-tech corporations, startups, venture investors, and analysts, we are still in a very early phase of generative AI. As a result, it is hard to assume, let alone declare, that generative AI will transform every business process driving operational efficiencies, create new revenue streams, result in

Recent automotive industry news made me realize again that the road to new mobility will not be a straight line. The twists and turns we encounter and will continue to encounter, will come as the result of economics, business models, industrial policy, politics, national security, but also culture. Mobility is

The current AI spring is in full swing. Entrepreneurs remain extremely excited about generative AI, as manifested by the number of financing requests our firm and many other investors continue to receive but are starting to think more diligently about where the white space they can go after. Corporations are

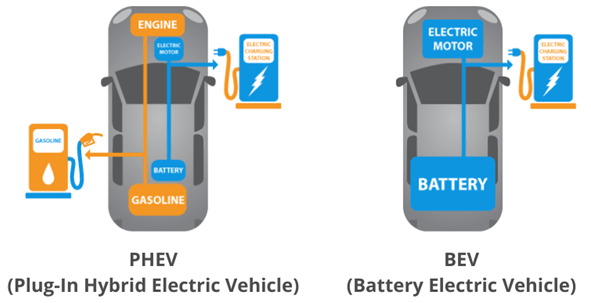

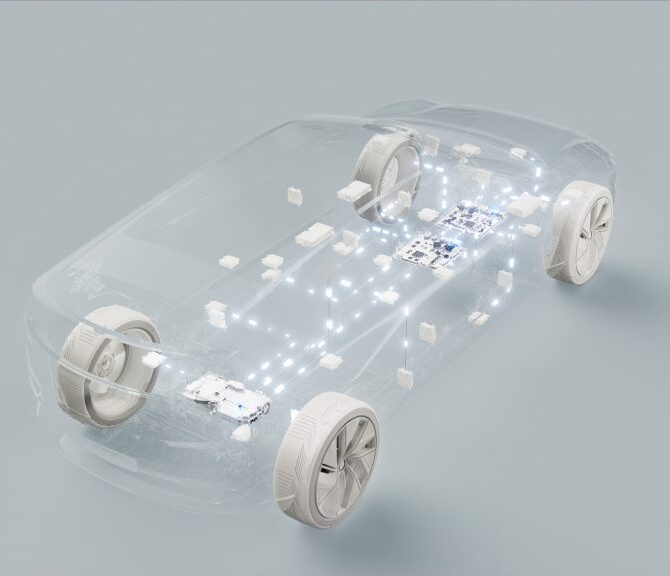

Automakers are facing a complex dilemma relating to software-defined new energy vehicles. Should they proceed with aggressively investing and developing software-defined vehicles while facing a slowdown in demand for battery electric vehicles (BEVs), or continue developing Internal Combustion Engine (ICE) and hybrid vehicles (including plug-in hybrids) that are based on

Enterprises use several different technologies, including AI, to automate their processes and create value. They are currently experimenting with generative AI to determine whether it can provide significant and enduring value. Is the enterprise’s excitement about generative AI justified? Is the size of the investments being made and planned warranted?

Another CES is behind us. The automotive and mobility extravaganza of years past was replaced this year by an AI extravaganza. For the automakers and their suppliers that participated at CES this year was about AI and Software-Defined Vehicles (SDVs). There were lots of demos involving AI and SDVs, and

Since the beginning of last year, the interest in AI has gone into overdrive. Enterprises tried to “out-announce” one another regarding their use of AI. Similarly, venture investors have been investing large sums at nosebleed valuations in startups developing anything that appears to involve generative AI. But, despite the corporate

We are still in the early phase of enterprises adopting generative AI. However, even at this early point enterprises must understand the costs associated with the use of Large Language Models (LLMs) as they embark on developing generative AI applications. These costs can become significant. The goal of this post

As with every previous AI era, the benefits promised to the enterprise from the application of generative AI will likely be lower than those that will be achieved. To succeed, enterprises must avoid the pitfalls of the previous AI eras. Over my 40-year career in enterprise AI, I understood the

Automakers want to capture a larger percentage of their customers’ lifetime value than they do today. As newcomer automakers, led by Tesla, are already demonstrating, to achieve this goal incumbents will need to offer services that the customer finds relevant. On Monday, Ford announced the creation of the Integrated Services

During the last six months, we spent time with our firm’s corporate partners to assess whether the enterprise is ready for generative AI and updated our investment theses accordingly. Our work convinced us that Large Language Models (LLMs)/Foundation Models and applications that incorporate them will open the door to the

Last week I attended Ford’s Capital Markets Day. Ford held the CMD to report on the progress of its three divisions and the goals they will be measured against. This piece focuses on the goals relating to software development and customer experience and their impact on the recurring monetization of

In the previous post, I discussed AI’s role in new mobility. I identified the three roles AI can play as an enabler, a differentiator, or a monetizer. The recent explosion of interest in generative AI begs the question: could generative AI contribute to new mobility and if so, in which

AI is viewed by many exclusively as a prediction technology. The availability of large, diverse, and information-rich data sets combined with the power of neural networks has been responsible for achieving incredible results even in complex, multi-faceted situations. Every aspect of new mobility has benefited from AI’s prediction power. The

Automakers must address two questions because of the environment they are currently facing. First, will they be able to make the announced Software-Defined Vehicle investments in the timeline they were projecting, or will they need to slow down their investment pace? Second, will they face any negative implications if they

During the last twenty-five years, the automotive customer journey has become more complex. Incumbent automakers have tried to become more involved in various stages of the customer journey to improve the customer experience and establish a direct relationship with the customer. Software-Defined Vehicles will enable a richer and more personalizable

The automotive industry is investing aggressively in the development of Software-Defined Vehicles. These vehicles greatly facilitate the vehicle’s electrification, optimization and personalization, as well as the attainment of higher levels of driving automation. More broadly, these vehicles change how the industry designs, makes, sells, and services vehicles, and in the

During the automotive industry’s current boom phase OEMs are announcing big, multi-year investments in new vehicle platforms that combine electrification with increasing driving automation. Because under new mobility data and loyalty will become central forms of value, OEMs must also consider deploying the loyalty-enhancing data-driven services these platforms enable. The

One of the main theses developed in Transportation Transformation is that, though still young, the app-based on-demand mobility services companies will need to transform before they can fully capture the opportunity afforded by new urban mobility. The book presents the decisions such companies must make and a framework that prescribes

Automation, combined with digitalization and process engineering, will enable organizations to broadly utilize telework, address talent scarcity, and lower production costs. However, even as we make progress with automation, onboarding new employees to a telework-centric organization is emerging globally as a major challenge. Even simple processes associated with employee onboarding

In the book Transportation Transformation, I stated that several megatrends will necessitate the transformation of urban mobility from one that is centered around the privately owned vehicle to one that is offered as a service, combines multiple modalities, and promotes sharing. The pandemic forced many of us to work from home

Our thesis is that after the pandemic telework will become a permanent corporate practice across industries rather than the emergency measure it is today. Many industries, including transportation, travel and hospitality, retail, education, and even manufacturing and healthcare, will broadly adopt telework. The post-pandemic adoption will be based on corporate

There is no question that the pandemic is having a big impact on new mobility. Passenger transportation is down as reported by the dramatic decreases in public transportation ridership and mobility services rides. At the same time, goods delivery services are growing fast as more households are adopting Ecommerce. With

This is the second piece of my collaboration with Nikos Michalakis, VP, Software Platform at Toyota Research Institute Advanced Development and it also appears on his Red Vest Mindset site. As companies continue to adjust their work practices due to the pandemic and extend the adoption of telework, industries such

Telework has been broadly adopted globally during the pandemic. It will also become a key component of the post-pandemic work environment, providing benefits to both employees and employers. To the employee, it will give flexibility, offer a better work experience, but also comfort related to the new safety norms being

It is hard, and not advisable, to make long-term decisions in the midst of the pandemic. But as certain mobility practices that are adopted during this period become part of our daily routines it is absolutely important to assess the potential of enduring after the pandemic. With that in mind,

Cities, and more broadly metropolitan areas, are the laboratories where many next-generation mobility concepts and technologies are being tested, and where the transformation of transportation will first become evident. Metropolitan areas are key to the success of new mobility. They are the centers where people choose to coexist in close

June proved an extremely important month to the ongoing transformation of urban transportation.

New urban mobility will emerge as a result of this transformation. New urban mobility will be a shift to the movement of consumers and goods provided as a service using vehicles of various form factors. In this piece I discuss what cities need to do in order to reap the advantages of new mobility and introduce the consumer’s urban transportation wallet as a composite metric for assessing a metropolitan area’s progress towards Mobility as a Service (MaaS).

The changes we have seen over the past 10 years in urban consumer transportation preferences with the ascend of on-demand mobility services should have convinced OEM executive teams that significant transformations of their business are necessary.

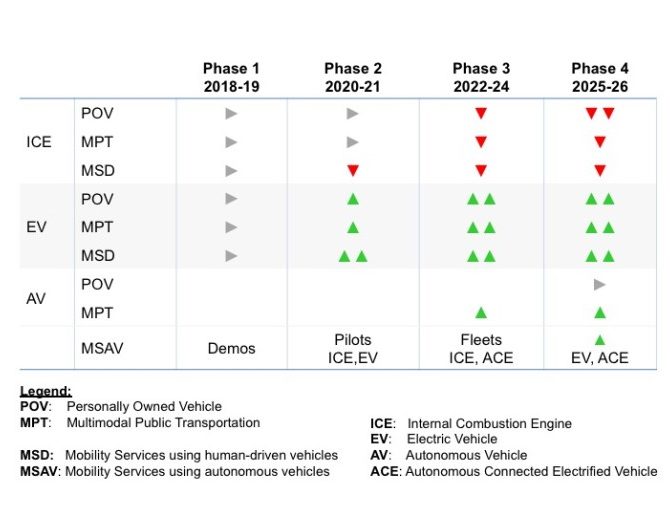

In my forthcoming book Transportation Transformation I define next-generation mobility as the intelligent movement of people and goods using automated (or autonomous), connected and electrified vehicles. Next-generation mobility is still in its infancy, but I predict it will unfold in three phases.

As a result of the movement restrictions imposed because of the pandemic, my 30-mile average daily travel around the Bay Area and the monthly airline trips have all become a 30-step walk to my home-office for video calls. While we’re all eagerly anticipating the lifesaving health outcomes from the measures taken towards the pandemic, the retail, travel, and hospitality industries are reeling.

n this second article we focus on on-demand mobility services, they issues they face, and the opportunities they have. The piece is pertinent to the conversation about California's AB5 and the conversation it is raising. It also provides a good preview of topics I am discussing in my upcoming book.

The automotive industry has survived many swings of feast and famine using a business model that is largely unchanged in a century. The industry has made a remarkable recovery in the decade since the Great Recession, with record sales and profits over the past five years. Yet despite this success, there is broad recognition something fundamental has changed and that focusing exclusively on the current business model is unwise.

This post presents an analysis of the autonomous vehicles innovation lifecycle. It introduces four dimensions for assessing AV innovation performance over time. Finally, it presents six requirements that will need to be addressed before the use of autonomous vehicles can scale for consumer transportation and logistics.

On-demand mobility services continue to evolve fast. New solutions are introduced constantly to address changes in consumer urban transportation tastes, or address shortcomings of existing offerings. Consumers demand for personalized transportation solutions that are affordable, convenient, and safe has led to the rapid growth of ride-hailing. But in cities where

The congressional and European Parliament testimonies of Facebook’s CEO focused attention on Internet and ecommerce corporations and startups whose business models rely on the collection and exploitation of big data, with personal data being a major component. Legislators and the public at large came to realize a) the leverage such

By extensively utilizing data, and paying attention to detail Tesla has changed the conversation on the type of personalized experience car owners (drivers and passengers) should expect from an automaker. In the process, it is building strong loyalty with the owners of its cars who appear willing to support it through thick and thin. Tesla has taken a lesson from Apple, Google, Facebook and Amazon, four companies that obsess about connecting pieces of data and using it to better understand their consumers and tailor their services to provide the right

On-Demand Mobility Services, and particularly ride-hailing, have emerged as a strong option for consumer urban transportation. In the process, ride-hailing has disrupted the taxi and limo industries and could next disrupt public transportation and last-mile goods delivery. Nowhere is this more evident than in cities such as New York and

In early November 2017, Waymo announced that while it will continue its tests in Washington, California, and Texas, it was ready to start ferrying consumers in its fleet of driverless minivans in Chandler, Arizona. Later the same month GM presented their roadmap for autonomous vehicles and details about the mobility services

In the previous post, I described a new value chain that will connect companies providing on-demand mobility and three emerging models for the realization of this value chain. This value chain is the result of the consumer shift from a car ownership-centric transportation model to a hybrid model that blends car ownership with mobility services, and the stated intent by the providers of certain of these services to adopt of Autonomous Connected Electrified (ACE) vehicles. A corresponding value chain, that we will examine in future posts, is being developed around the application of ACE

In my book and previous posts, I build a broad case for the importance of big data and AI in next-generation mobility, and provide several examples of data that is being collected, or can be collected, in a variety of transportation and logistics situations. Next-generation mobility is about autonomous vehicles, electrified vehicles, and on-demand shared mobility and the

The pace of innovation in Fast Moving Consumer Goods (FMCG) is increasing, helped by trends such as the increasing importance of millennials, changes in consumer preferences and the willingness of retailers to experiment. The result has been small players (less than $1B in sales) outperforming established brands in 18 of the top 25 Consumer Packaged Goods (CPG) categories.

Synapse Partners is actively looking for investments in the Manufacturing and Supply Chain and Logistics sectors because we believe it is an area where the combination of rich new sources of sensor data and a maturation of AI technologies will drive tremendous efficiency improvements. Key to realizing these opportunities will be the introduction of new Insightful Applications – software applications that translate complex data sets into actionable business insights. This blog post will be the first in a series of posts that will dig into some of the more interesting trends as well as

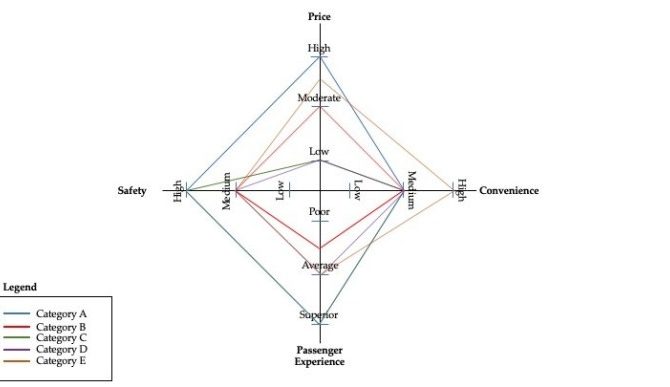

The Consumer Electronics Show (CES) is starting later this week and will be followed by the Detroit Auto Show (DAS). Both shows will serve as venues for the automotive industry to showcase Autonomous Connected Electrified (ACE) vehicles and new Mobility Services. ACE vehicles combined with Mobility Services such as ridesharing, car sharing and multimodal transportation options will give rise to a new personal mobility model that combines car ownership with car access. These innovations and the emerging model are creating two challenges for the automotive